/

Warrants

Warrants

Stefan Willebrand

Owned by Stefan Willebrand

Warrants

Warrants are described here: http://www.investopedia.com/ask/answers/08/stock-option-warrant.asp

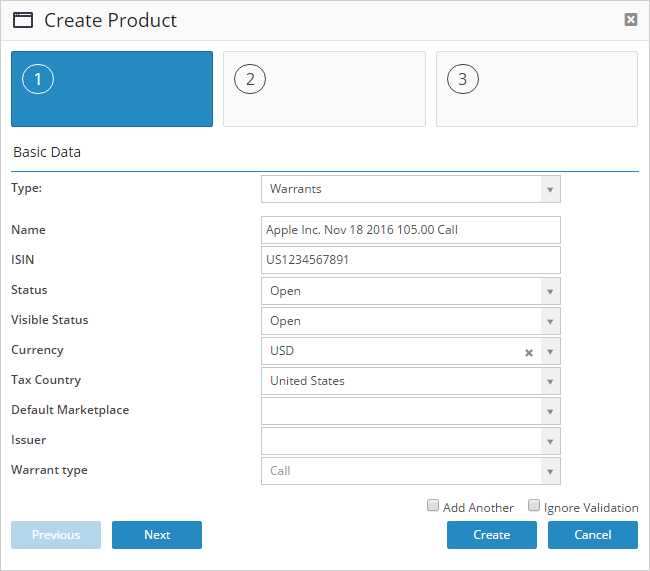

For this example we are going to configure a call warrant in Apple with strike price 105 USD with expiration in November 2016.

| Property | Description | Available from version |

|---|---|---|

| Type | The instrument type | |

| Name | The name of the instrument | |

| ISIN | The ISIN-code of the instrument | |

| Status | The status determines what user type the instrument should be available to | |

| Visible Status | The status determines what user type the instrument should be visible to | |

| Currency | The currency that the instrument is based in | |

| Tax Country | The country where the instrument is based according to tax reasons | |

| Default Marketplace | The default marketplace where the instrument is traded | |

| Issuer | The legal entity that has issued the instrument, for example Apple Inc. | |

| Strike price | If the warrant gives the right to the shares in this example at a certain price the value can be defined here | 2.04 |

| Underlying units | The number of underlying units that the warrant covers, in this example we should enter 100. | 2.04 |

| Underlying instrument | Here we can search for another registered instrument and link to this warrant, for example the stock Apple if we have registered it. | 2.04 |

| Warrant type | This is where we define if the warrant is a call or put | 2.04 |

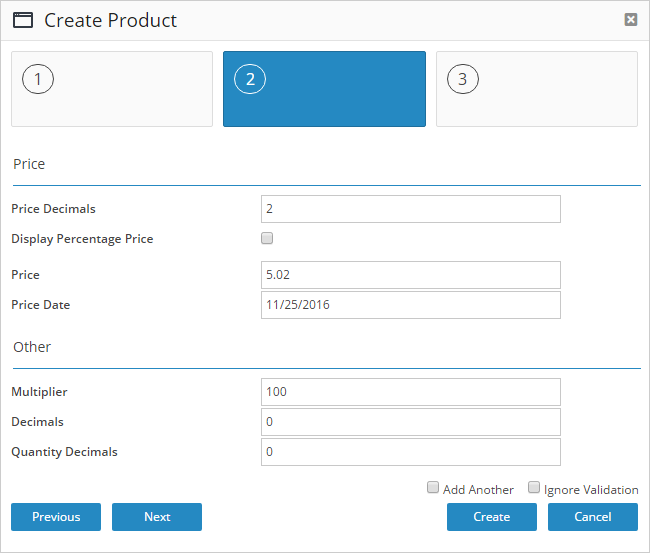

| Property | Description |

|---|---|

| Price Decimals | The number of decimals to use when showing the price of the instrument |

| Display Percentage Price | If checked the price will be displayed as a percentage value, in the database the value of 98% will be stored as 0.98 but shown as 98%. In this example we are using currency values as the price. |

| Price | The price of the instrument |

| Price Date | The date when the price was set |

| Multiplier | The value multiplier of the instrument. Since the underlying number of units for this instrument is 100 shares we are going to set the multiplier to 100. This means that if 1 warrant is traded at a price of 100 the cost of that trade will be 502 USD (1 warrant x 5.02 price x 100 shares). |

| Decimals | This is a legacy property that should be left blank |

| Quantity Decimals | This is the number of decimals that should be used for the units. The option is traded in whole units and thus we write 0 for this value. |

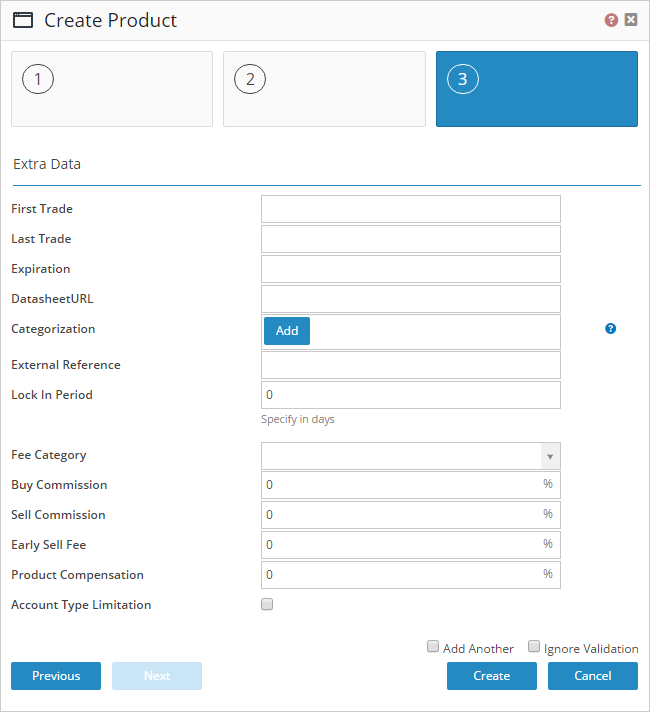

| Property | Description |

|---|---|

| First Trade | The first date on which the instrument should be available for trading |

| Last Trade | The last date on which the instrument should be available for trading |

| Expiration | The date on which the instrument will expire |

| Datasheet URL | A link to an instrument description |

| Categorization | Instrument Categorization |

| External Reference | A reference that could be used to link the instrument to an external system or some other reference |

| Lock In Period | The period that a legal entity should be locked in before being able to sell after having purchased the instrument |

| Fee Category | Which fee category the instrument should belong to according to /wiki/spaces/KB/pages/66584622 |

| Buy Commission | The percentage commission charged on buy orders |

| Sell Commission | The percentage commission charged on sell orders |

| Early Sell Fee | The percentage fee charged on orders that are being executed within the lock in period. |

| Product Compensation | The percentage of kickback that should be given to the associated re-seller on the orders of the instrument |

| Account Type Limitation | Determines if the instrument should be limited to certain account types. |

© 2009 - 2023 Huddlestock Technologies AB All rights reserved | Huddlestock Terms of use | Support portal