Create and Update Bonds

Lena Birath

Stefan Willebrand

Create Bond

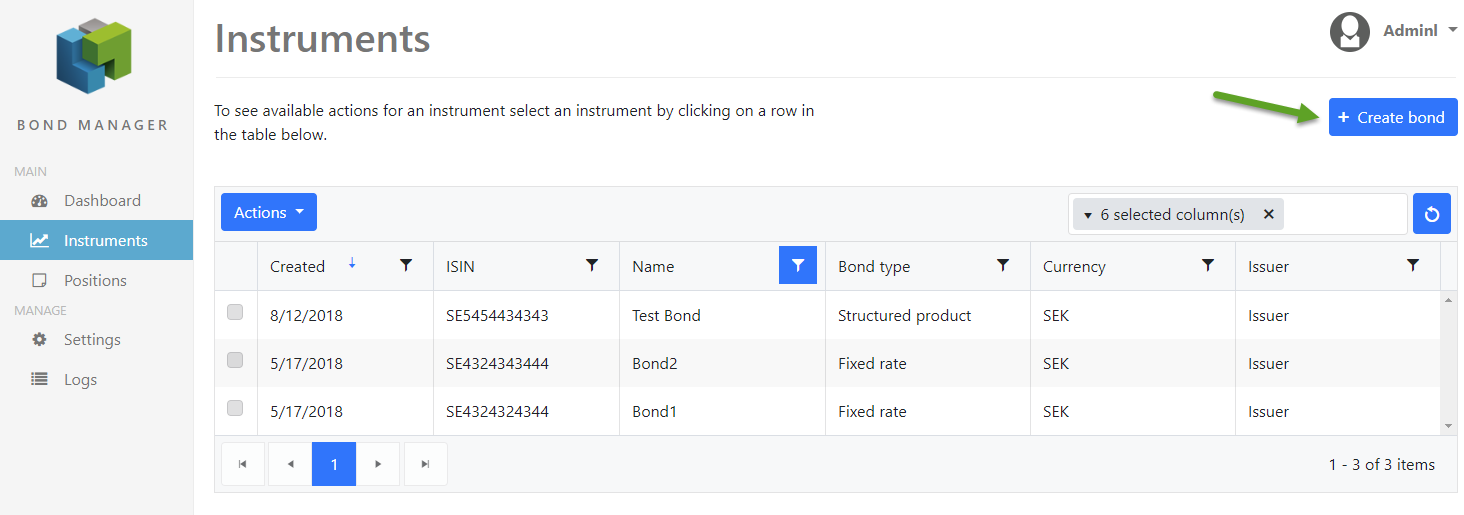

Navigate to Instruments > Create Bond to create a bond instrument.

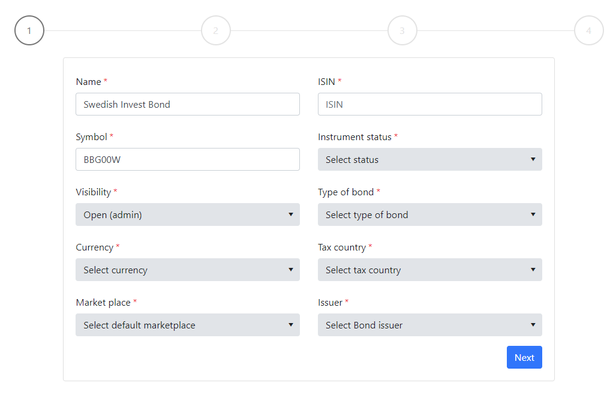

Follow the wizard in four steps to create the bond. Fields marked with a star (*) are mandatory.

| Property | Description |

|---|---|

| Name | Name of the instrument |

| ISIN | The ISIN-code of the instrument |

| Symbol | Bloomberg Open Symbology which can be found here. |

| Instrument Status | Controls the availability i.e. whether an instrument is tradable. |

| Visibility | The listing of instruments. I.e. if an instrument is visible for a particular user. |

| Type of bond | Convertible, Fixed rate, Floating rate, Zero coupons, Exchangeable, Structured product |

| Currency | The currency that the instrument is based in. The currencies that are available in the Bricknode instance is shown as options |

| Tax country | The country where the instrument is based according to tax reasons. The countries available in Bricknode Broker. |

| Market Place | The default marketplace where the instrument is traded. The Trading Venues that are listed in the Bricknode Broker. |

| Issuer | Legal entities in Bricknode Broker that have issued the instrument |

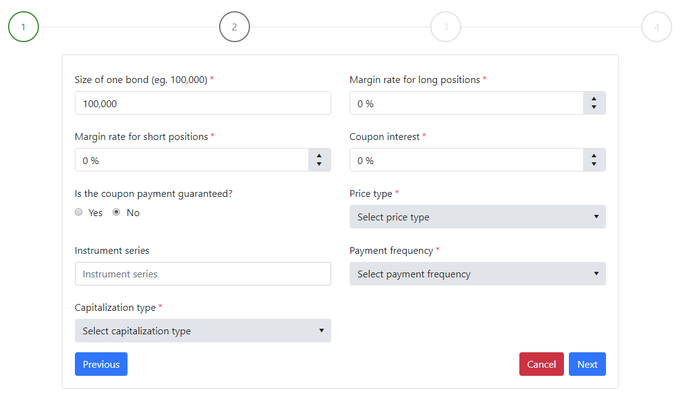

| Property | Description |

|---|---|

| Multiplier | The size of the bond should be entered here. |

| Margin rate for long positions | This is the margin rate that could be applied for long positions. |

| Margin rate for short positions | This is the margin rate that could be applied for short positions. |

| Coupon interest | The interest that will be paid as the coupon. |

| Is the coupon payment guaranteed? | Self-explanatory |

| Price type | Dirty or Clean price |

| Instrument series | A free text field where you can enter if the instrument belongs to any series. |

| Payment frequency | How often will the coupon payment occur? |

| Capitalization type | Accrued interest is being applied every night to the instrument and this selection defines how often the accrued interest should be capitalized. This is an information field and is not linked to any function which means that you have to trigger the capitalization manually in the application. |

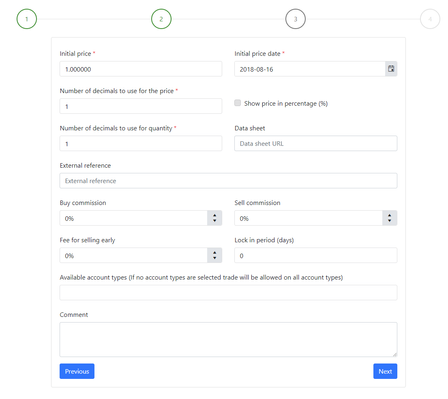

| Property | Description |

|---|---|

| Initial price | The price of the instrument |

| The price date of the instrument | |

| Number of decimals to use for the price | The number of decimals to use when showing the price of the instrument |

| Show price in percentage (%) | If checked, the price will be displayed as a percentage value. |

| Number of decimals to use for quantity | The number of decimals that should be used for the tradable units. |

| Datasheet | A link to an instrument description (URL) |

| External reference | A reference that could be used to link the instrument to an external system or some other reference. |

| Buy commission | The percentage commission charged on buy orders. |

| Sell commission | The percentage commission charged on sell orders. |

| Fee for selling early | The percentage fee charged on orders that are being executed within the lock-in period. |

| Lock in period (days) | The period that a legal entity should be locked in before being able to sell after having purchased the bond. |

| Available account types | Here you can select which account types that should be able to place trades in the instrument. If no account types are entered then the instrument will be able to be traded in all account types. |

| Comment | This is a free text comment where you can enter any text that you would like to tag to the instrument. |

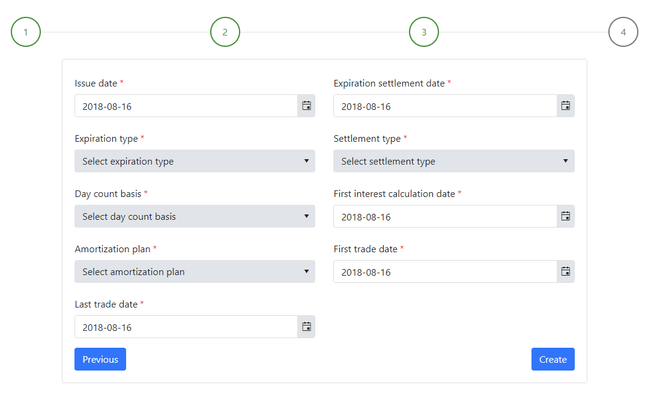

| Properties | Description |

|---|---|

| Issue date | The date the instrument is issued. |

| Expiration settlement date | The date on which the deliverable (cash or other assets) will be settled following the expiration of the instrument. |

| Expiration type | American or European expiration |

| Settlement type | If settlement for the instrument will be done in cash or physical delivery of the deliverable asset. |

| Day count basis | The day count basis that should be used for the interest rate calculations. The available options are: Actual/Actual |

| First interest calculation date | The first date on which the accrued interest will start accumulating. |

| Amortization plan | This is the periodization that should be used for the amortization payments of the bond. The available options are: Monthly |

| First trade date | The first date on which the instrument should be available for trading. |

| Last trade date | The last date on which the instrument should be available for trading. |

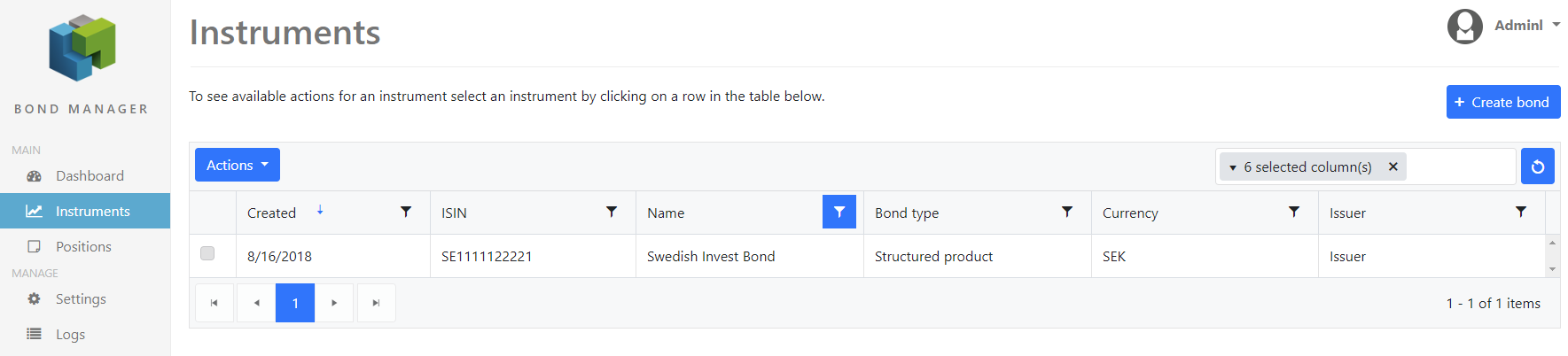

Click Create to Create the bond. The instrument is now visible in the Instrument list.

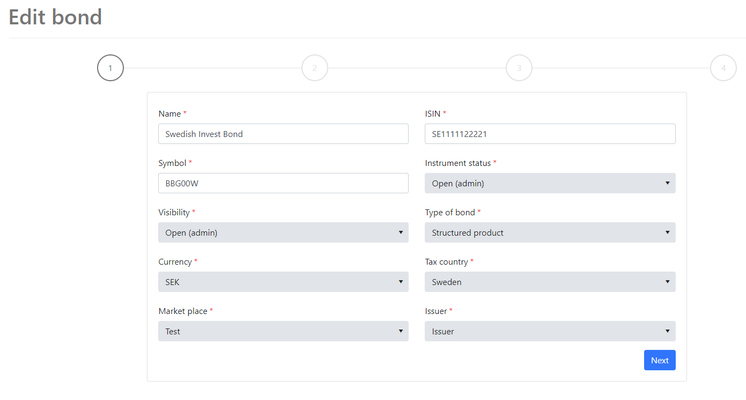

Update/Edit Bonds

Navigate to Instruments.

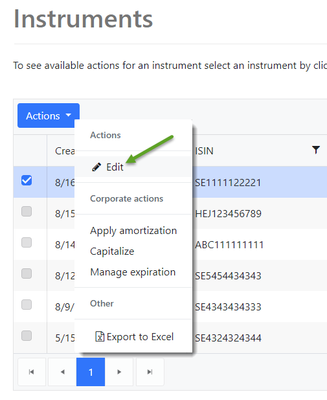

Mark the instrument that you want to edit and click the Action menu and select Edit.

Now you can update the bond. Follow the guide to page 4 to Save the changes.

Related content

© 2009 - 2023 Huddlestock Technologies AB All rights reserved | Huddlestock Terms of use | Support portal