Lender Deposits

Former user (Deleted)

Mattias Brian

Stefan Willebrand

Import Lender deposits via BGC file

A back end user can import Lender deposits by navigation to the menu option Daily Process → Choosing the tab Import Lender Deposits.

File Validation

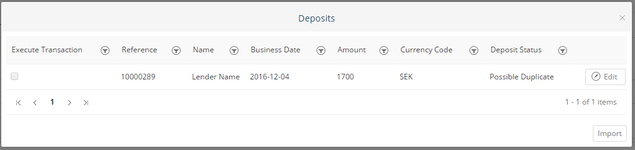

This import takes a BGC file as input. If any structural errors is found regarding the file during the import a exception will be thrown. Validation of the BGC file is also performed by the system to handle any user issues for example a user might try to import the same file multiple times. If multiple imports of the same file occurs the system presents a table with all the possible duplicates where backoffice will be given the option to force the import or to not include it at all.

A deposit will get the status "Possible duplicate" if the account has a transaction with the same Amount (and currency), the same Day as businessdate in the file.

If all order is OK and no possible duplicate is found the table will not show and the payments in the file will be imported.

Important

The Global Setting BankGiroLenderPayments need to have a valid BankGiro value to successfully import a Lender deposit. Note that this BankGiro number should only contain numbers and be stored in format: XXXXXXX (replace X with your BG number). The validation process looks at this setting to separate a Lender deposit from a Borrower payment and to determain the correct route for the deposit to take within Bricknode Lending.

Process

When importing the file a number of transaction and events will occur in Bricknode Lending and BFS.

For each row a transaction of type LenderDeposit will be created in BFS on a cash account called Lender Payment. If Bricknode Lending cant match the deposit to a lender it will create a transaction called LenderPaymentUnmatched on a exception account. If this occurs one manually needs to transfer the deposit to the correct lender when a counterparty is found.

A Bfs transfer notification is created in Bricknode Lending (navigate to Dashboard → Bfs transfers grid to view) and the action specified in the notification must be resolved manually by the back end user.

Important

Transactions in BFS

Example below shows the transaction flow for two deposits on 500 SEK each and one unmatched deposit on 100 SEK.

Account | BusinessTransactionType | Amount | BFSTransfer |

|---|---|---|---|

| cust_4 (Lender Payment Account) | LenderDeposit | + 1100 SEK | |

| cash_6 (Lender Payment Account) | LenderDeposit | + 1100 SEK | |

| cust_4 (Lender Payment Account) | LenderDeposit | - 1100 SEK | |

| cash_6 (Lender Payment Account) | LenderDeposit | - 1100 SEK | |

| cust_1 (Payments Custody Account) | LenderDeposit | + 1100 SEK | Create BFSTransfer FromAccount: Lender Payment Account ToAccount: Payments Custody Account |

| cash_3 (Cash Account) | LenderDeposit | + 1100 SEK | |

| cash_3 (Cash Account) | LenderDeposit | - 500 SEK | |

| cash_3 (Cash Account) | LenderDeposit | - 500 SEK | |

| cash_3 (Cash Account) | UnmatchedPayment | - 100 SEK | |

| Lender1 Account | LenderDeposit | + 500 SEK | |

| Lender2 Account | LenderDeposit | + 500 SEK | |

| exception_1 (Unmatched deposits) | LenderPaymentUnmatched | + 100 SEK |

© 2009 - 2023 Huddlestock Technologies AB All rights reserved | Huddlestock Terms of use | Support portal