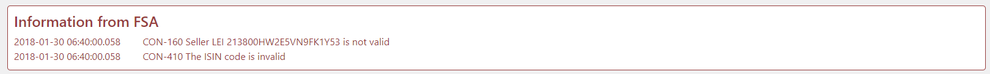

Information from FSA

The TRS-manager application automatically checks for status updates from FSA and imports these in the application. If the transaction has been rejected or pending there is information from FSA to be found on the transaction in the transactions list of TRS-manager. In the table below you can find short descriptions of the errors and status updates received from FSA. All information on this page and much more can be found at FSA´s webpage about Testreporting in TRS2.

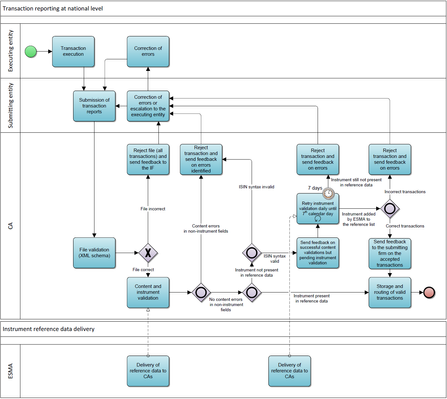

Transaction reporting process

The picture below describes the FSA process of transaction reporting at a national level (further information can be found in the following document 2016-1521_mifir_transaction_reporting_technical_reporting_instructions.pdf).

Error codes

TRS-manager imports and processes status files from FSA once each hour. If the transaction is rejected or pending from FSA the application updates the transaction with the error codes received in the file. This can then be viewed on the transaction details in TRS-manager.

The table below shows the possible error codes and their meaning. You can also read more about the error codes in the following Excel file from FSA: esma65-8-2594_annex_1_mifir_transaction_reporting_validation_rules (2).xlsx Use the FSA field number and Field name to find more information about format and validation on this page: Errors, fields and validation

| Status code | Status text | More information | FSA field no | Field name |

|---|---|---|---|---|

| CON-023 | Transaction report with the same transaction reference number has already been sent for the firm and not cancelled | If the report is a new transaction, the transaction reference number shall pertain to a single transaction per the executing entity, i.e. the same transaction reference number has not been used before or pertains to a transaction that has been cancelled (the last accepted report with this transaction reference number was a cancellation report). | 2 | Transaction Reference number |

| CON-024 | Transaction for cancellation cannot be found | If the report is a cancellation report, a transaction with the same transaction reference number should have been reported by the executing entity before. | 2 | Transaction Reference number |

| CON-025 | Transaction has already been cancelled | If the report is a cancellation report, this transaction should be an active transaction (there was no cancellation report following the last accepted new transaction report for this transaction reference number). | 2 | Transaction Reference number |

| CON-030 | Trading venue transaction identification code is inconsistent with the trading venue | This field must not be populated where field 36 (Venue) is populated with a MIC pertaining to a non-EEA Trading Venue or 'XXXX' or 'XOFF' or a MIC pertaining to a Systematic Internaliser. | 3 | Trading venue transaction identification code |

| CON-040 | The executing entity LEI is not valid | Where field 5 (Investment Firm covered by Directive 2014/65/EU) is populated with 'true', this field shall be populated with a LEI accurately formatted and in the LEI database included in the GLEIF database maintained by the Central Operating Unit. 1. The status of the LEI shall be "Issued", "Pending transfer" or "Pending archival". 2. The InitialRegistrationDate of the LEI shall be equal or before the trading date. 3. The EntityStatus shall be Active or if the EntityStatus is Inactive, the LastUpdateDate shall be equal or after the trading date. If the status of the LEI is "Lapsed" in the LEI reference data as of the transaction execution date, an additional check should be performed in the LEI reference data as of the transaction submission date and the status of the LEI in this version of the reference data shall be "Issued", "Pending transfer" or "Pending archival". | 4 | Executing entity identification code |

| CON-041 | The executing entity LEI is not valid | Where field 5 (Investment firm covered by Directive 2014/65/EU) is populated with 'false', this field shall be populated with a LEI accurately formatted and in the LEI database included in the GLEIF database maintained by the Central Operating Unit. 1. The status of the LEI shall be "Issued", "Pending transfer" "Pending archival" or "Lapsed". 2. The InitialRegistrationDate of the LEI shall be equal or before the trading date. 3. The EntityStatus shall be Active or if the EntityStatus is Inactive, the LastUpdateDate shall be equal or after the trading date. | 4 | Executing entity identification code |

| CON-060 | Submitting entity LEI is not valid | This field shall be populated with a LEI accurately formatted and in the LEI database included in the GLEIF database maintained by the Central Operating Unit. 1. The status of the LEI shall be "Issued", "Lapsed", "Pending transfer" or "Pending archival". 2. The InitialRegistrationDate of the LEI shall be equal or before the submission date. 3. The EntityStatus shall be Active or if the EntityStatus is Inactive, the LastUpdateDate shall be equal or after the submission date. The submission date should be the system date at the moment of delivery of the data to the competent authority. | 6 | Submitting entity identification code |

| CON-070 | Buyer LEI XXX is not valid | If LEI is used, this field shall be populated with a LEI accurately formatted and in the LEI database included in the GLEIF database maintained by the Central Operating Unit. The following conditions shall be met for transactions executed on 3 July 2018 or later: The following conditions shall be met for transactions executed until 2 July 2018: | 7 | Buyer identification code |

| CON-071 | Buyer national identification code XXX does not include valid country code | If national identifier is used, the first 2 characters of the national identification code should be an ISO 3166 country code that was valid at the trading date | 7 | Buyer identification code |

| CON-072 | Buyer MIC XXX is not valid for the trade date | If MIC code is used, it should be a valid ISO 10383 MIC code indicating a trading venue that was active at the trading date, excluding special MIC codes 'XXXX' and 'XOFF' | 7 | Buyer identification code |

| CON-073 | The CONCAT code XXX is incorrect | If the CONCAT code is used, the birthdate in the CONCAT code should be the same as the birthdate populated in field 11 (Buyer - date of birth). | 7 | Buyer identification code |

| CON-074 | The format of the buyer identification code XXX is incorrect | In case the CONCAT code is used, the following characters are only allowed: Capital Latin letters, Numbers, #. It should be a string of exactly 20 characters where first two characters are letters, the next 8 characters are numbers and the remaining characters are letters or #, where 11th and 16th character are letters. In case national identification number or passport number is used, the following characters are only allowed: capital Latin letters (A-Z), numbers (0-9) as well as “+” and “-“ in case the identifier starts with "FI" and "-" when the identifier starts with "LV". It can be a string of 3 to 35 characters, where first two characters are letters. | 7 | Buyer identification code |

| CON-080 | Country code XXX is not valid for the trade date | If populated, it should be an ISO 3166 country code that was valid at the trading date | 8 | Country of the branch for the buyer |

| CON-120 | Buyer decision maker LEI XXX is not valid | If LEI is used, this field shall be populated with a LEI accurately formatted and in the LEI database included in the GLEIF database maintained by the Central Operating Unit. The following conditions shall be met for transactions executed on 3 July 2018 or later: The following conditions shall be met for transactions executed until 2 July 2018: | 12 | Buyer decision maker code |

| CON-121 | Buyer decision maker identification code XXX does not include valid country code | If national identifier is used, the first 2 characters of the national identification code should be an ISO 3166 country code that was valid at the trading date | 12 | Buyer decision maker code |

| CON-122 | The CONCAT code XXX is incorrect | If the CONCAT code is used, the birthdate in the CONCAT code should be the same as the birthdate populated in field 15 (Buyer decision maker - Date of birth). | 12 | Buyer decision maker code |

| CON-123 | The format of the buyer decision maker code XXX is incorrect | In case the CONCAT code is used, the following characters are only allowed: Capital Latin letters, Numbers, #. It should be a string of exactly 20 characters where first two characters are letters, the next 8 characters are numbers and the remaining characters are letters or #, where 11th and 16th character are letters. In case national identification number or passport number is used, the following characters are only allowed: capital Latin letters (A-Z), numbers (0-9) as well as “+” and “-“ in case the identifier starts with "FI" and "-" when the identifier starts with "LV". It can be a string of 3 to 35 characters, where first two characters are letters. | 12 | Buyer decision maker code |

| CON-160 | Seller LEI XXX is not valid | If LEI is used, this field shall be populated with a LEI accurately formatted and in the LEI database included in the GLEIF database maintained by the Central Operating Unit. The following conditions shall be met for transactions executed on 3 July 2018 or later: | 16 | Seller identification code |

| CON-161 | Seller national identification code XXX does not include valid country code | If national identifier is used, the first 2 characters of the national identification code should be an ISO 3166 country code that was valid at the trading date | 16 | Seller identification code |

| CON-162 | Seller MIC XXX is not valid for the trade date | If MIC code is used, it should be a valid ISO 10383 MIC code indicating a trading venue that was active at the trading date, excluding special MIC codes 'XXXX' and 'XOFF' | 16 | Seller identification code |

| CON-163 | The CONCAT code XXX is incorrect | If the CONCAT code is used, the birthdate in the CONCAT code should be the same as the birthdate populated in field 20. | 16 | Seller identification code |

| CON-164 | The format of the seller identification code XXX is incorrect | In case the CONCAT code is used, the following characters are only allowed: Capital Latin letters, Numbers, #. It should be a string of exactly 20 characters where first two characters are letters, the next 8 characters are numbers and the remaining characters are letters or #, where 11th and 16th character are letters. In case national identification number or passport number is used, the following characters are only allowed: capital Latin letters (A-Z), numbers (0-9) as well as “+” and “-“ in case the identifier starts with "FI" and "-" when the identifier starts with "LV". It can be a string of 3 to 35 characters, where first two characters are letters. | 16 | Seller identification code |

| CON-170 | Country code XXX is not valid for the trade date | If populated, it should be an ISO 3166 country code that was valid at the trading date | 17 | Country of the branch for the seller |

| CON-210 | Seller decision maker LEI XXX is not valid | If LEI is used, this field shall be populated with a LEI accurately formatted and in the LEI database included in the GLEIF database maintained by the Central Operating Unit. The following conditions shall be met for transactions executed on 3 July 2018 or later: | 21 | Seller decision maker code |

| CON-211 | Seller decision maker identification code XXX does not include valid country code | If national identifier is used, the first 2 characters of the national identification code should be an ISO 3166 country code that was valid at the trading date | 21 | Seller decision maker code |

| CON-212 | The CONCAT code XXX is incorrect | If the CONCAT code is used, the birthdate in the CONCAT code should be the same as the birthdate populated in field 24 (Seller decision maker - Date of birth). | 21 | Seller decision maker code |

| CON-213 | The format of the seller decision maker identification code XXX is incorrect | In case the CONCAT code is used, the following characters are only allowed: Capital Latin letters, Numbers, #. It should be a string of exactly 20 characters where first two characters are letters, the next 8 characters are numbers and the remaining characters are letters or #, where 11th and 16th character are letters. In case national identification number or passport number is used, the following characters are only allowed: capital Latin letters (A-Z), numbers (0-9) as well as “+” and “-“ in case the identifier starts with "FI" and "-" when the identifier starts with "LV". It can be a string of 3 to 35 characters, where first two characters are letters. | 21 | Seller decision maker code |

| CON-251 | Transmission of order indicator is incorrect | When the executing entity is dealing on its own account or matched principal basis (value ‘DEAL’ or ‘MTCH’ populated in field 29 (Trading capacity)) this field must be populated with ‘false’. | 25 | Transmission of order indicator |

| CON-260 | Firm transmitting identification code for the buyer LEI is not valid | This field shall be populated with a LEI accurately formatted and in the LEI database included in the GLEIF database maintained by the Central Operating Unit. 1. The status of the LEI shall be "Issued", "Lapsed", "Pending transfer" or "Pending archival". 2. The InitialRegistrationDate of the LEI shall be equal or before the trading date. 3. The EntityStatus shall be Active or if the EntityStatus is Inactive, the LastUpdateDate shall be equal or after the trading date. | 26 | Transmitting firm identification code for the buyer |

| CON-270 | Firm transmitting identification code for the seller LEI is not valid | This field shall be populated with a LEI accurately formatted and in the LEI database included in the GLEIF database maintained by the Central Operating Unit. 1. The status of the LEI shall be "Issued", "Lapsed", "Pending transfer" or "Pending archival". 2. The InitialRegistrationDate of the LEI shall be equal or before the trading date. 3. The EntityStatus shall be Active or if the EntityStatus is Inactive, the LastUpdateDate shall be equal or after the trading date. | 27 | Transmitting firm identification code for the seller |

| CON-280 | Trading date time is in the future | Trading date time must be before the reception date time (i.e. when the file including the transaction was received by the NCA). | 28 | Trading date time |

| CON-281 | Trade date is too far in the past | Trading date cannot be earlier than the agreed date of the first trading date to be reported under MiFIR or earlier than 5 years before the current date. | 28 | Trading date time |

| CON-290 | When using 'DEAL' either Buyer or Seller should be identical with the executing entity identification code | When using 'DEAL' Buyer Identification or Seller Identification or both of them should be identical with the executing entity identification code. | 29 | Trading capacity |

| CON-310 | Currency code is not valid for the trade date | A valid ISO 4217 currency code that was active at the trading date or is a pre-EURO currency should be populated. The following special currency codes are not allowed: XAG, XAU, XBA, XBB, XBC, XBD, XDR, XEU, XFU, XPD, XPT, XXX. | 31 | Quantity currency |

| CON-330 | Price notation is incorrect | In case the CFI code is reported in field 43 (Instrument classification) (transaction in a financial instrument that is not admitted to trading): For debt instruments, i.e. CFI reported in field 43 is D*****, where the quantity is reported in unit terms, the reported price shall not be in percentage terms. | 33 | Price |

| CON-331 | Price notation is incorrect | In case the CFI code is available in the instrument reference data (transaction in an instruments admitted to trading): For debt instruments, i.e. where CFI of the instrument in the reference data is D*****, where the quantity is reported in unit terms, the reported price shall not be in percentage terms. | 33 | Price |

| CON-340 | Currency code is not valid for the trade date | A valid ISO 4217 currency code that was active at the trading date should be populated. The following special currency codes are not allowed: XAG, XAU, XBA, XBB, XBC, XBD, XDR, XEU, XFU, XPD, XPT, XXX. | 34 | Price currency |

| CON-350 | Net amount is missing | In case the CFI code is reported in field 43 (Instrument classification) (transaction in a financial instrument that is not admitted to trading): The field is mandatory for debt instruments, i.e. CFI reported in field 43 (Instrument classification) is DB**** (Bonds) | 35 | Net amount |

| CON-351 | Net amount is missing | In case the CFI code is available in the instrument reference data (transaction in an instruments admitted to trading): The field is mandatory for debt instruments, i.e. CFI of the instrument in the reference data is DB**** (Bonds) | 35 | Net amount |

| CON-360 | Venue MIC is not valid for the trade date | The reported code should be a valid ISO 10383 MIC code that was active at the trading date | 36 | Venue |

| CON-361 | The reported MIC code is incorrect | If the instrument reported in field 41 (Instrument identification code) is present in reference data, 'XXXX' cannot be reported in field 36 (Venue). I.e. if 'XXXX' populated in field 36 (Venue) (Tx\TradVn), full instrument description must be provided in FinInstrm\Othr (FinInstrm\Id must not be used) and ISIN reported in FinInstrm\Othr\FinInstrmGnlAttrbts\Id must not be present in reference data. | 36 | Venue |

| CON-370 | Country of branch membership is missing | This field is mandatory where: MIC populated in field 36 (Venue) pertains to an EEA trading venue or trading platform outside the Union, excluding Systematic Internalisers (i.e. this field can be left blank for transactions executed on Systematic Internalisers). | 37 | Country of the branch membership |

| CON-371 | Country code is not valid for the trade date | If populated, it should be an ISO 3166 country code that was valid at the trading date | 37 | Country of the branch membership |

| CON-372 | Country of branch membership is inconsistent with the MIC populated in field 36. | This field must not be populated where field 36 (Venue) is populated with 'XXXX' or 'XOFF' or a MIC pertaining to a Systematic Internaliser. | 37 | Country of the branch membership |

| CON-380 | Up-front payment is missing | In case the CFI code is reported in field 43 (Instrument classification) (transaction in a derivative instrument that is not admitted to trading): Field is mandatory where the CFI reported in field 43 (Instrument classification) is SC**** (CDS) | 38 | Up-front payment |

| CON-381 | Up-front payment is missing | In case the CFI code is available in the instrument reference data (transaction in an instruments admitted to trading): Field is mandatory where the CFI of the instrument in the reference data is SC**** (CDS) | 38 | Up-front payment |

| CON-390 | Currency code is not valid for the trade date | A valid ISO 4217 currency code that was active at the trading date should be populated. The following special currency codes are not allowed: XAG, XAU, XBA, XBB, XBC, XBD, XDR, XEU, XFU, XPD, XPT, XXX. | 39 | Up-front payment currency |

| CON-410 | The ISIN code is invalid | The check digit of the ISIN code should be valid according to the algorithm of ISIN validation, as defined in the ISO 6166:2013 standard, Annex C Formula for computing the modulus 10 double-add-double" check digit. | 41 | Instrument identification code |

| CON-411 | If no more than 7 days has passed after the transaction submission (i.e. it is the 7th day or before) the transaction shall be pending with the following message: Pending instrument validation | The instrument should be present in reference data for the trading date for the following transactions: 1. The transaction is executed on a trading venue within EEA (MIC code in field 36 (Venue) belongs to a trading venue within the EEA); 2. The transaction is an OTC transaction in instrument admitted to trading (field 36 (Venue) populated with 'XOFF') and field 47 (Underlying instrument code) and 48 (Underlying index name) are not populated; 3. The transaction is executed on a SI or an organised trading platform outside EEA and field 47 (Underlying instrument code) and 48 (Underlying index name) are not populated. In the case of transactions on EEA venues (point 1 above), the instrument should be valid on the particular trading venue where the transaction was executed. In the case of the other transactions (point 2 and 3), the instrument should be valid on any (at least one) EEA trading venue or SI. | 41 | Instrument identification code |

| CON-412 | If at least 7 days has passed after the transaction submission (i.e. it is the 8th day after the submission) the transaction shall be rejected with the following error message: Instrument is not valid in reference data on transaction date | The instrument should be present in reference data for the trading date for the following transactions: 1. The transaction is executed on a trading venue within EEA (MIC code in field 36 (Venue) belongs to a trading venue within the EEA); 2. The transaction is an OTC transaction in instrument admitted to trading (field 36 (Venue) populated with 'XOFF') and field 47 (Underlying instrument code) and 48 (Underlying index name) are not populated; 3. The transaction is executed on a SI or an organised trading platform outside EEA and field 47 (Underlying instrument code) and 48 (Underlying index name) are not populated. In the case of transactions on EEA venues (point 1 above), the instrument should be valid on the particular trading venue where the transaction was executed. In the case of the other transactions (point 2 and 3), the instrument should be valid on any (at least one) EEA trading venue or SI. | 41 | Instrument identification code |

| CON-430 | Instrument classification identifier is incorrect | The reported CFI should be an allowed CFI according to the ISO 10962:2015. | 43 | Instrument classification |

| CON-431 | CFI code is inconsistent with option exercise style. | The instrument classification should be consistent with option style (field 53 (Option exercise style)): 1. If field 53 (Option exercise style) = EURO, then one of the following CFI codes should be used: O*E***, H**A**, H**D**, H**G**, RW***E, RF***E 2. If field 53 (Option exercise style) = AMER, then one of the following CFI codes should be used: O*A***, H**B**, H**E**, H**H**, RW***A, RF***A 3. If field 53 (Option exercise style) = BERM, then one of the following CFI codes should be used: O*B***, H**C**, H**F**, H**I**, RW***B, RF***B | 43 | Instrument classification |

| CON-440 | Currency code is not valid for the trade date | A valid ISO 4217 currency code that was active at the trading date or is a pre-EURO currency should be populated. The following special currency codes are not allowed: XAG, XAU, XBA, XBB, XBC, XBD, XDR, XEU, XFU, XPD, XPT, XXX. | 44 | Notional currency 1 |

| CON-441 | Notional Currency 1 is missing | Field is mandatory where Field 43 (Instrument classification) is populated with: 1. Other instruments with the following CFI attributes: O*****, S*****, C*****, R*****, F*****, E*****, D*****, H*****, J***** | 44 | Notional currency 1 |

| CON-450 | Notional currency 2 was populated but Notional currency 1 is missing. | Field can be only populated when field 44 (Notional currency 1) was also populated | 45 | Notional currency 2 |

| CON-451 | Currency code is not valid for the trade date | A valid ISO 4217 currency code that was active at the trading date or is a pre-EURO currency should be populated. The following special currency codes are not allowed: XAG, XAU, XBA, XBB, XBC, XBD, XDR, XEU, XFU, XPD, XPT, XXX. | 45 | Notional currency 2 |

| CON-452 | Notional Currency 2 is missing | This field is mandatory where field 43 (Instrument classification) is populated with: 1. Swaps with the following CFI attributes : SF**** 2. Futures with the following CFI attributes: FFC*** | 45 | Notional currency 2 |

| CON-453 | Notional currency 2 is not applicable for the given instrument | This field should not be populated where field 43 (Instrument classification) is populated with: 1. Options with the following CFI attributes: O**S**, O**D**, O**T**, O**N** 2. Futures with the following CFI attributes: FFS***, FFD***, FFN***, FFV***, FC**** 3. Swaps with the following CFI attributes: ST**** 4. Complex options with the following CFI attributes: HT****, HE****, HF**** 5. Other classes of instruments with the following CFI attributes: R*****, E*****, C*****, D*****, J***** | 45 | Notional currency 2 |

| CON-470 | The ISIN code XXX is invalid | The check digit of the ISIN code should be valid according to the algorithm of ISIN validation, as defined in the ISO 6166:2013 standard, Annex C Formula for computing the modulus 10 double-add-double check digit. | 47 | Underlying instrument code |

| CON-471 | If no more than 7 days has passed after the transaction submission (i.e. it is the 7th day or before) the transaction shall be pending with the following message: Pending underlying instrument XXX validation | The underlying instrument should be present in reference data for the trading date for the following transactions: 1. The transaction is an OTC transaction: a) field 36 (Venue) is populated with 'XXXX'; and b) the underlying instrument is not an index; 2. The transaction was executed on a non-EEA organised trading platform: a) field 36 (Venue) is populated with a non-EEA MIC code or 'XOFF'; and b) the instrument (field 41 (Instrument identification code)) is not populated or populated with an instrument that is not present in the reference data; and c) the underlying instrument is not an index; In the case of baskets, if more than one basket constituent is populated, all of them should be present in the instrument reference data. Where the submitting entity populates not only the reportable components but also non-reportable ones, the report is pended and, after the 7 calendar days, rejected (unless the non-reportable components become reportable within that 7 calendar day period). | 47 | Underlying instrument code |

| CON-472 | If at least 7 days has passed after the transaction submission (i.e. it is the 8th day after the submission) the transaction shall be rejected with the following error message: Underlying instrument XXX is not valid in reference data on transaction date | The underlying instrument should be present in reference data for the trading date for the following transactions: 1. The transaction is an OTC transaction: a) field 36 (Venue) is populated with 'XXXX'; and b) the underlying instrument is not an index; 2. The transaction was executed on a non-EEA organised trading platform: a) field 36 (Venue) is populated with a non-EEA MIC code or 'XOFF'; and b) the instrument (field 41 (Instrument identification code)) is not populated or populated with an instrument that is not present in the reference data; and c) the underlying instrument is not an index; In the case of baskets, if more than one basket constituent is populated, all of them should be present in the instrument reference data. Where the submitting entity populates not only the reportable components but also non-reportable ones, the report is pended and, after the 7 calendar days, rejected (unless the non-reportable components become reportable within that 7 calendar day period). | 47 | Underlying instrument code |

| CON-473 | No underlying reported for swap transaction. | For swap transactions where field 43 (Instrument classification) is populated with S*****, at least one swap leg consisting of a single instrument, an index or a basket should be reported with the direction indication (i.e. the underlying must be reported using the UndrlygInstrm\Swp\SwpIn or UndrlygInstrm\Swp\SwpOut XML elements). | 47 | Underlying instrument code |

| CON-480 | Direct underlying index name is missing | This field is mandatory where field 43 (Instrument classification) is populated with 1. Options with the following CFI attributes: O**I**, O**N** 2. Futures with the following CFI attributes: FFI***, FFN*** 3. Entitlements with the following CFI attributes: RWI*** | 48 | Underlying index name |

| CON-481 | Underlying index name is not applicable for the given instrument | This field should not be populated where field 43 (Instrument classification) is populated with: 1. Debt instruments with the following CFI attributes: DB****, DT****, DY**** 2. Other instruments with the following CFI attributes: E***** | 48 | Underlying index name |

| CON-490 | Term of the underlying index is missing | This field is mandatory where field 43 (Instrument classification) is populated with 1. Options with the following CFI attributes : O**N** 2. Futures with the following CFI attributes : FFN*** | 49 | Term of the underlying index |

| CON-500 | Option type is missing | Field is mandatory where field 43 (Instrument classification) is populated with: 1. Options with the following CFI attributes: O***** or H***** 2. Warrants with the following CFI attributes: RW**** | 50 | Option type |

| CON-501 | Option type is not applicable for the given instrument | This field should not be populated where field 43 (Instrument classification) is populated with: 1. Instruments with the following CFI attributes: F*****, S*****, E*****, C*****, D*****, J***** | 50 | Option type |

| CON-502 | Option type does not match instrument classification | If CFI code is 1. 'OC****', 'H**A**', 'H**B**', 'RW**C*' or 'H**C**', then option type should be 'CALL' 2. 'OP****', 'H**D**', 'H**E**', 'RW**P*' or 'H**F**', then option type should be 'PUTO' 3. 'OM****', 'H**G**', 'H**H**', 'RW**B*' or 'H**I**', then option type should be 'OTHR' | 50 | Option type |

| CON-510 | Strike Price is missing | Field is mandatory where field 43 (Instrument classification) is populated with: 1. Options with the following CFI attributes: O***** or H***** 2. Warrants with the following CFI attributes: RW**** | 51 | Strike price |

| CON-511 | Strike price is not applicable for the given instrument | This field should not be populated where field 43 (Instrument classification) is populated with: 1. Instruments with the following CFI attributes: F*****, S*****, E*****, C*****, D*****, J***** | 51 | Strike price |

| CON-520 | Currency code is not valid for the trade date | A valid ISO 4217 currency code that was active at the trading date should be populated. The following special currency codes are not allowed: XAG, XAU, XBA, XBB, XBC, XBD, XDR, XEU, XFU, XPD, XPT, XXX. | 52 | Strike price currency |

| CON-530 | Option exercise style is missing. | Field is mandatory where field 43 (Instrument classification) is populated with: 1. Options with the following CFI attributes: O***** or H***** 2. Warrants with the following CFI attributes: RW**** | 53 | Option exercise style |

| CON-531 | Option exercise style is not applicable for the given instrument | This field should not be populated where field 43 (Instrument classification) is populated with: 1. Instruments with the following CFI attributes: F*****, S*****, E*****, C*****, D*****, J***** | 53 | Option exercise style |

| CON-540 | Maturity date is missing | This field is mandatory where field 43 (Instrument classification) is populated with 1. D***** | 54 | Maturity date |

| CON-541 | Maturity date is incorrect | The maturity date should be equal or later than the trading day (field 28). | 54 | Maturity date |

| CON-542 | Maturity date is not applicable for the given instrument | This field should not be populated where field 43 (Instrument classification) is populated with: 1. Instruments with the following CFI attributes: R*****, O*****, F*****, S*****, E*****, C*****, H*****, J***** | 54 | Maturity date |

| CON-550 | Expiry date is missing | Field is mandatory where field 43 (Instrument classification) is populated with: 1. Options with the following CFI attributes: 'O*****' 2. Futures with the following CFI attributes: F***** 3. Forwards with the following CFI attributes: JC**F* | 55 | Expiry date |

| CON-551 | Expiry date is not applicable for the given instrument | This field is should not be populated where field 43 (Instrument classification) is populated with: 1. Instruments with the following CFI attributes: E*****, C*****, D***** | 55 | Expiry date |

| CON-552 | Expiry date is incorrect | The expiry date should be equal or later than the trading day (field 28). | 55 | Expiry date |

| CON-560 | Delivery type is incorrect | Where field 43 (Instrument classification) is populated with one of the following CFI codes: OC**P*, OP**P*, FF*P**, FC*P**, SR***P, ST***P, SE***P, SC***P, SF***P, SM***P, HR***P, HT***P, HE***P, HC***P, HF***P, HM***P, IF***P, JE***P, JF***P, JC***P, JR***P, JT***P, LL***P, this field should be populated with 'PHYS'. Where field 43 (Instrument classification) is populated with one of the following CFI codes: OC**C*, OP**C*, FF*C**, FC*C**, SR***C, ST***C, SE***C, SC***C, SM***C, HR***C, HT***C, HE***C, HC***C, HF***C, HM***C, JE***C, JF***C, JC***C, JR***C, JT***C, LL***C, this field should be populated with 'CASH'. | 56 | Delivery type |

| CON-570 | Investment decision identifier is missing | Field must be always populated where the entity deals on own account (i.e. value 'DEAL' populated in field 29 (Trading capacity)) and the firm does not act as a receiving firm (fields 26 (Transmitting firm identification code for the buyer) or 27 (Transmitting firm identification code for the seller) are not populated). | 57 | Investment decision within firm |

| CON-571 | Investment decision identifier should not be populated in reports where the firm deals on a matched principal capacity or an any other capacity unless the decision maker field is populated with the LEI of the executing firm. | Field should not be populated in reports where the transmitting firm identification code is not populated for the buyer or seller (fields 26 (Transmitting firm identification code) and 27 (Transmitting firm identification code for the seller)) and the firm deals on a matched principal capacity (i.e. value 'MTCH' populated in field 29 (Trading capacity)) or an any other capacity (i.e. value 'AOTC' populated in field 29 (Trading capacity)) unless the decision maker field is populated with the LEI of the executing entity. This rule should be interpreted as follows: Field 57 (Investment decision within firm) should be left blank (not populated): • the transmitting firm identification code is not populated for the buyer (fields 26 (Transmitting firm identification code) is blank); and • the transmitting firm identification code is not populated for the seller (field 27 (Transmitting firm identification code for the seller) is blank); and • the firm deals on a matched principal capacity or an any other capacity (i.e. value 'MTCH' or 'AOTC' is populated in field 29 (Trading capacity)); and • any of LEIs populated in the buyer decision maker (field 12) is different from the LEI of the executing firm; and • any of LEIs populated in the seller decision maker (field 21) is different from the LEI of the executing firm. | 57 | Investment decision within firm |

| CON-572 | Investment decision identifier should not be populated in reports where the firm deals on a matched principal capacity or an any other capacity and the transmitting firm identification code is populated for the buyer and/or seller unless the decision maker field is populated with the LEI of the transmitting firm. | Investment decision identifier should not be populated in reports where the firm deals on a matched principal capacity (i.e. value 'MTCH' populated in field 29 (Trading capacity)) or an any other capacity (i.e. value 'AOTC' populated in field 29 (Trading capacity)) and the transmitting firm identification code is populated for the buyer and/or seller unless the decision maker field is populated with the LEI of the transmitting firm. This rule should be interpreted as follows: Field 57 (Investment decision within firm) should be left blank (not populated) if: - the firm deals on a matched principal capacity (i.e. value 'MTCH' populated in field 29 (Trading capacity)) or an any other capacity (i.e. value 'AOTC' populated in field 29 (Trading capacity)); and one or both of the below conditions are true o the transmitting firm for the buyer (field 26 (Transmitting firm identification code)) is populated and the value is different from any of LEIs populated in the buyer decision maker (field 12); or o the transmitting firm for the seller (field 27 (Transmitting firm identification code for the seller)) is populated and the value is different from any of LEIs populated in the seller decision maker (field 21). | 57 | Investment decision within firm |

| CON-573 | The national identification code does not include valid country code | If national identifier is used, the first 2 characters of the national identification code should be an ISO 3166 country code that was valid at the trading date | 57 | Investment decision within firm |

| CON-574 | The format of the executing person code is incorrect | In case the CONCAT code is used, the following characters are only allowed: Capital Latin letters, Numbers, #. It should be a string of exactly 20 characters where first two characters are letters, the next 8 characters are numbers and the remaining characters are letters or #, where 11th and 16th character are letters. In case national identification number or passport number is used, the following characters are only allowed: capital Latin letters (A-Z), numbers (0-9) as well as “+” and “-“ in case the identifier starts with "FI" and "-" when the identifier starts with "LV". It can be a string of 3 to 35 characters, where first two characters are letters. | 57 | Investment decision within firm |

| CON-580 | Country code is not valid for the trade date | If populated, it should be an ISO 3166 country code that was valid at the trading date. | 58 | Country of the branch responsible for the person making the investment decision |

| CON-590 | The national identification code does not include valid country code | If national identifier is used, the first 2 characters of the national identification code should be an ISO 3166 country code that was valid at the trading date. | 59 | Execution within firm |

| CON-591 | The format of the executing person code is incorrect | In case the CONCAT code is used, the following characters are only allowed: Capital Latin letters, Numbers, #. It should be a string of exactly 20 characters where first two characters are letters, the next 8 characters are numbers and the remaining characters are letters or #, where 11th and 16th character are letters. In case national identification number or passport number is used, the following characters are only allowed: capital Latin letters (A-Z), numbers (0-9) as well as “+” and “-“ in case the identifier starts with "FI" and "-" when the identifier starts with "LV". It can be a string of 3 to 35 characters, where first two characters are letters. | 59 | Execution within firm |

| CON-600 | Country code is not valid for the trade date | If populated, it should be an ISO 3166 country code that was valid at the trading date. | 60 | Country of the branch supervising the person responsible for the execution |

| CON-610 | Waiver indicator is inconsistent with trading venue | This field should NOT be populated where: 1. Field 36 (Venue) is 'XOFF', 'XXXX' or a non-EEA venue | 61 | Waiver indicator |

| CON-640 | Commodity derivative indicator is missing | Field is mandatory for commodity derivative transaction where the instrument reported in field 41 (Instrument identification code) is classified in instrument reference data as commodity derivative (i.e. field 4 in instrument reference data is populated with 'true'). | 64 | Commodity derivative indicator |

| CON-820 | Date and time of data reception by the CA is incorrect | Reception must be the same or after the trading date (field 28 (Trading date time)). | - | Date and time of data reception by the CA |

Related content

© 2009 - 2023 Huddlestock Technologies AB All rights reserved | Huddlestock Terms of use | Support portal