NFM Order Routing

The video below offers an overview of the order routing service.

To get started with NFM Order Routing we need to configure the following in BFS.

Set up each Fund Company (Fund companies) as a legal entity

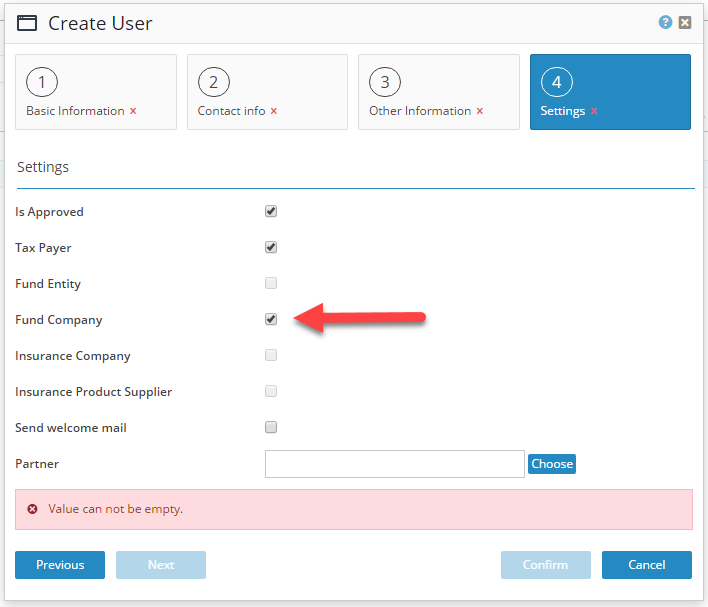

We simply navigate to User Management → Companies and create a new company where we set the property Fund Company to checked.

Set up each Fund entity as a legal entity

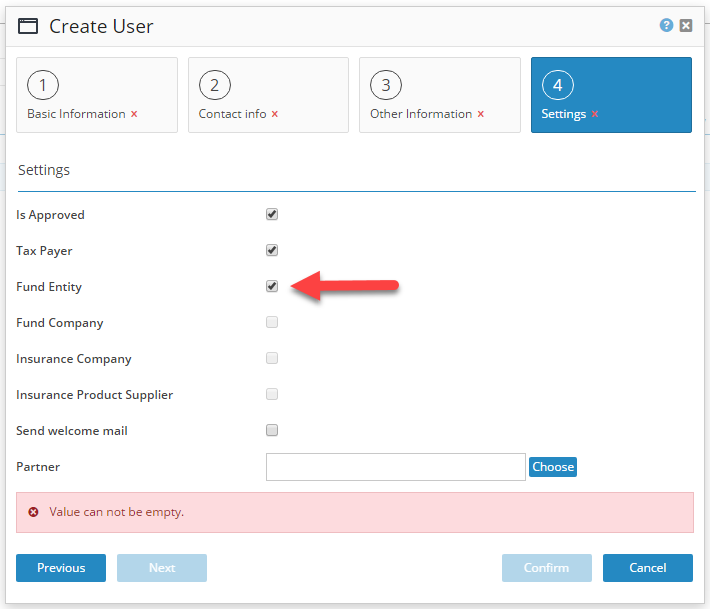

In the same way as for the Fund Company we set up the investment fund as a legal entity and check the box Fund Entity.

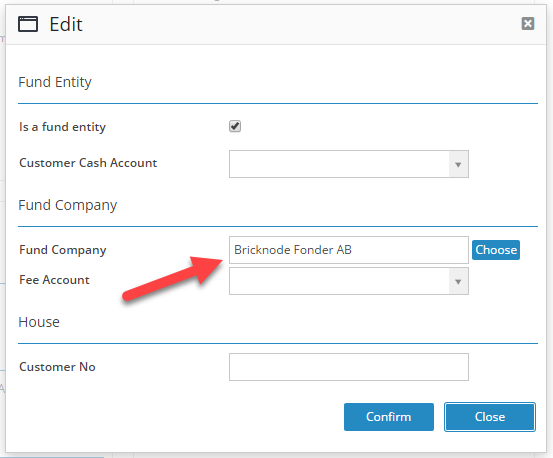

We then need to go into details of the fund entity and select the fund company.

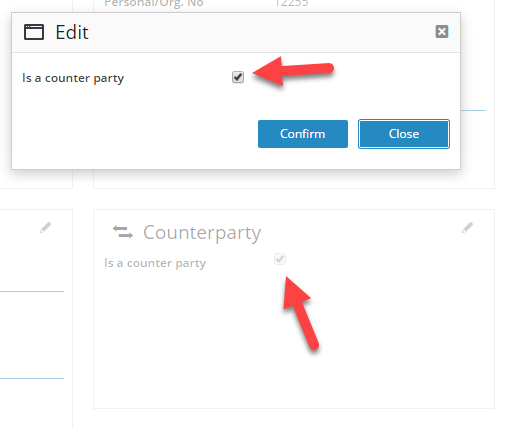

We also need to check the box Counterparty in the details for the fund entity so that it is possible to select this legal entity as a counterparty when we add the trade route NFM to the tradeable instrument.

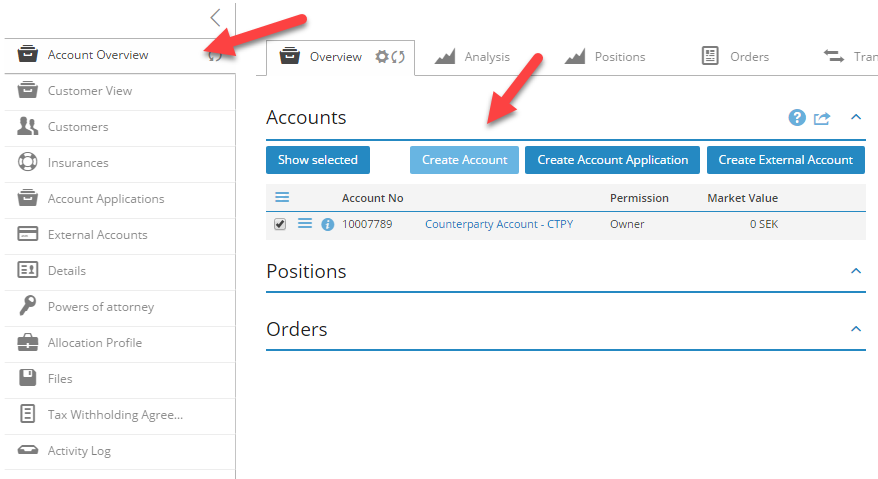

Finally we need to create a counterparty account for the fund entity, BFS will ask us if we want to create an account once we have registered the legal entity but we can also navigate to account overview and create an account of the type Counterparty from there.

Set up Custody account and External account (payment receiver)

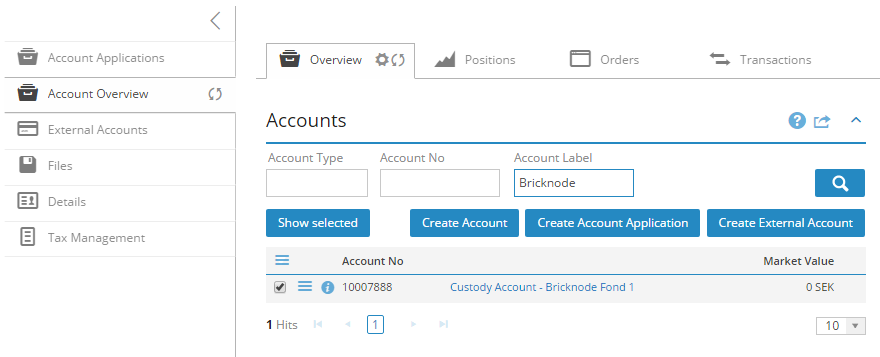

When we send money to the investment fund we need to reflect this in BFS and show where the cash is kept until the investment fund executes the orders, following that we also need to keep track of who is keeping the record of our fund holdings. We do this by creating a new custody account for the house which we name the same as the fund entity.

Navigate to the house view and create a new Custody account.

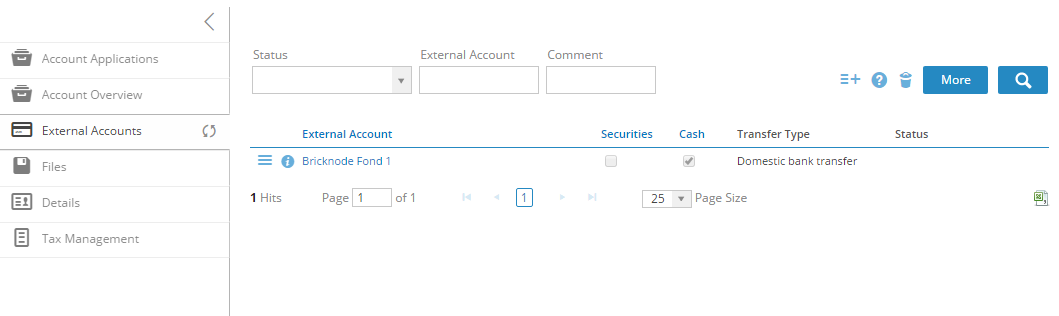

When we then send money to the investment fund we need to keep track of what bank account we are sending the money to, the payment receiver which is called external accounts in BFS. Depending on which custody bank you are using BFS can generate transfer instructions for the bank using this information.

Navigate to External Accounts and create the correct payment receiver.

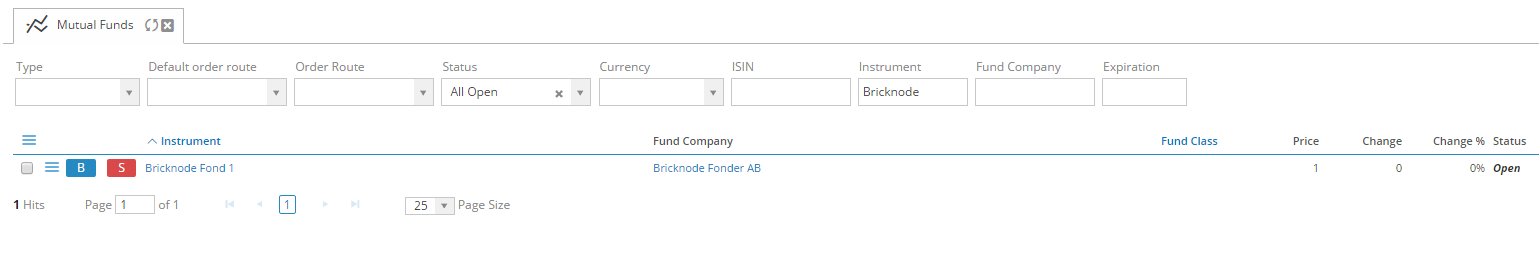

Set up the fund instrument

The last step is setting up the fund instrument with exactly the same information that NFM has on record when it comes to name, ISIN and currency.

To enable trading through NFM we also have to add the trade route (Execution Interface) which is described in the following article Execution Interface NFM / Allfunds.

We can now continue with the actual trading according to the following article Trade funds with Nordic Fund Market.

Important final note

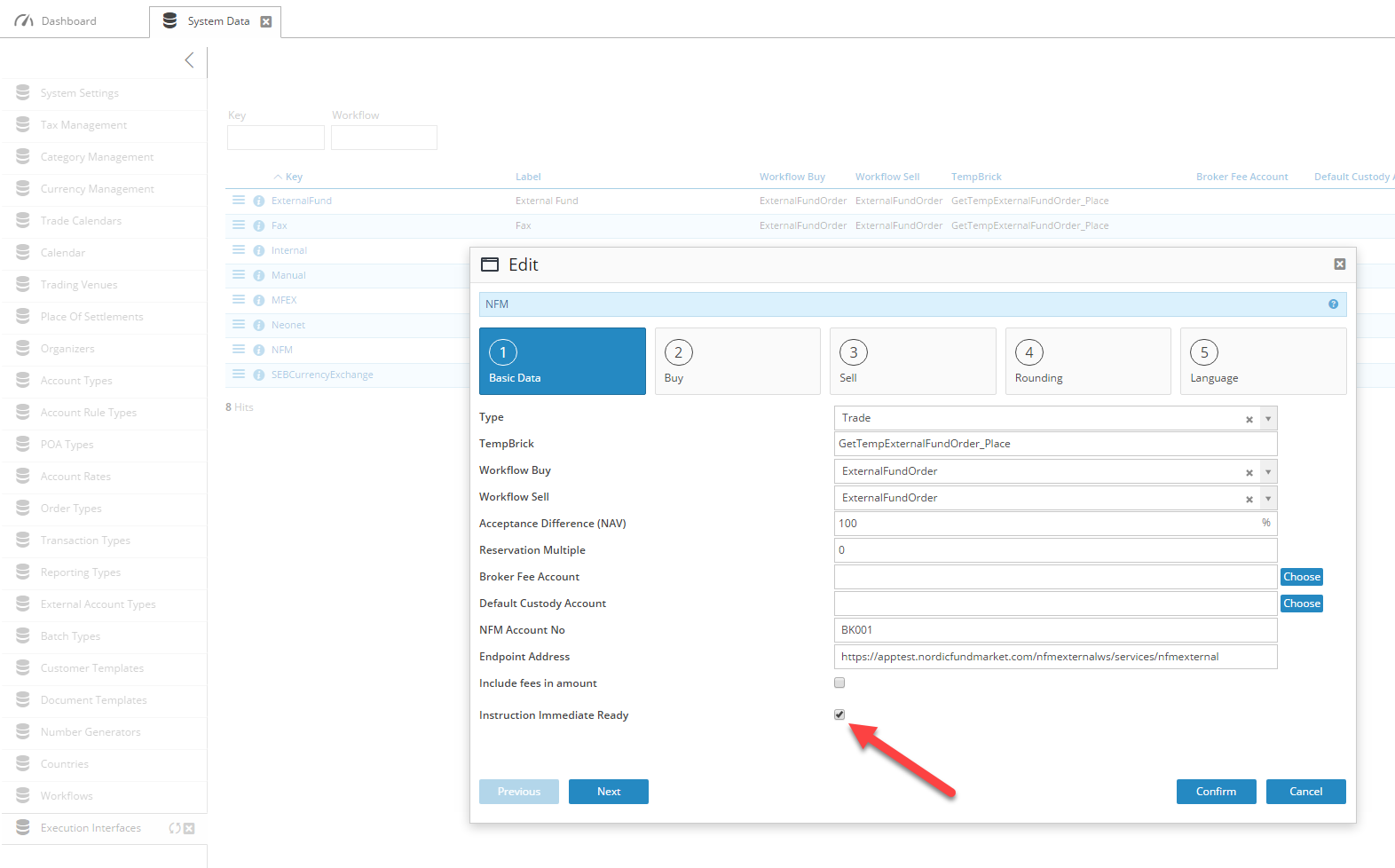

In order for NFM to work automatically the resulting fund instructions must have the status "ready" when they are created in order for them to get automatically sent to NFM at cutoff. This is enabled by navigating to the Global Execution Interface in System Data → Execution Interfaces → NFM and then edit to check the box in the image below.

BFS will conduct the following automated communication with NFM

| Time (Central European Time) | Description |

|---|---|

| 10:00 am | Create batch orders and fund instructions |

| 10:30 am | Send fund instructions to NFM |

| 11:00 am | Get order status from NFM |

| 11:30 am | Get executions from NFM |

Related content

© 2009 - 2023 Huddlestock Technologies AB All rights reserved | Huddlestock Terms of use | Support portal