Trade investment funds directly with fund entities using your own book

BFS Version: 2.X

When executing trades for your customers using investment funds there are a few common ways to go about it.

- Execute the trade directly without passing the trade over your own book

- Execute the trade by first passing through your own book

With the first option you do not have a way to net trades but you can aggregate the trades before transmitting the trades to the fund, this is called aggregation where buy orders and sell order can be aggregated together.

Example of aggregation and netting

- Customer 1 enters a trade to buy 1,000 EUR worth of Fund A

- Customer 2 enters a trade to buy 1,000 EUR worth of Fund A

- Customer 3 enters a trade to sell 1,000 EUR worth of Fund A

Using aggregation you would send the following trades to Fund A:

- Buy 2,000 EUR worth of Fund A

- Sell 1,000 EUR worth of Fund A

If you would pass the trades through your own book you would only have to send the netted trade to Fund A:

- Buy 1,000 EUR worth of Fund A

Using your own book there is also a possibility to fill the trades for your customers with you as the counterparty to the trades and then you can decide for yourself when to send the external order to the fund, during the time you will have a trading risk.

This article will describe how to trade investment funds for your customers using your own book using Bricknode Financial Systems ("BFS").

There are a few prerequisites that are required before conducting these types of trades.

- A Fund company and a Fund entity together with a Fund Instrument has to be created with the fund instrument having two execution interfaces as described in the article Fund Instruments

- Since the fund entity will be your counterparty to the trades you have to create two accounts for the fund entity of the type counterparty accounts, one should be called "Internal CTPY" and one should be called "External CTPY"

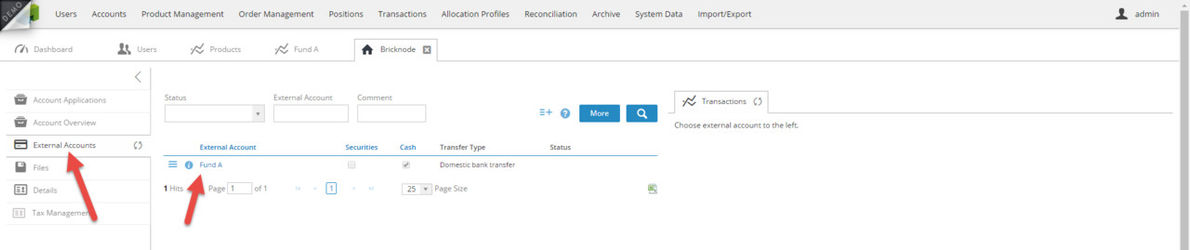

- In order to send payments to the fund entity you need to create a payment receiver (External Account) for your company, the House.

- A Custody account has to be created for your company, the House, that represents the account that you will have at the fund entity

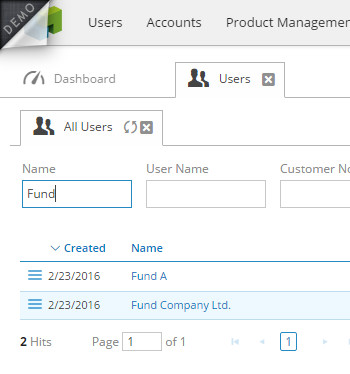

For this article we have created the following Fund company and Fund entity:

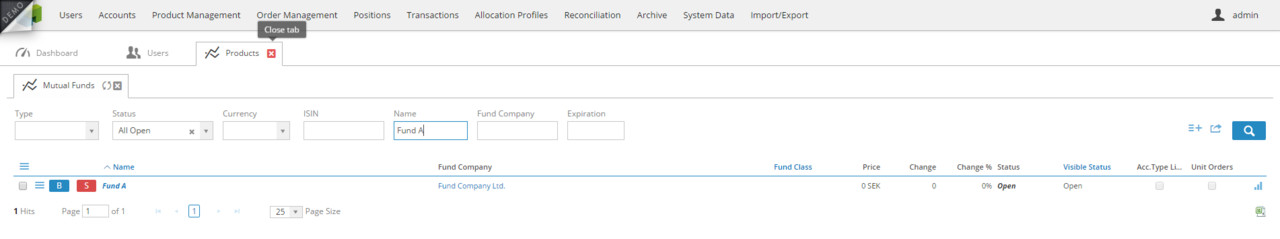

We have also created the following Fund Instrument:

Within external accounts for the house we have created a payment receiver for the fund:

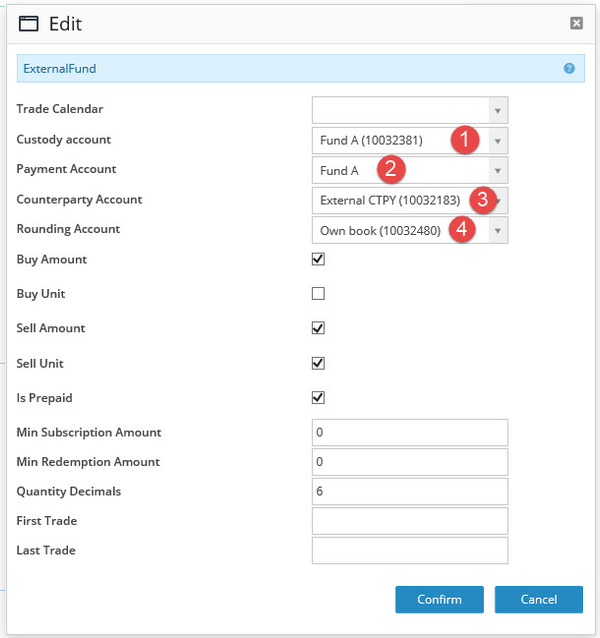

The configuration for the execution interface of the type "External Fund" looks like this:

- The selected Custody Account is where the fund units will be stored which typically is on register with the Fund and we represent that as a Custody Account within BFS.

- The payment account holds the information of where the funds are going to be sent with the payment instruction information. This is an External Account registered with the House as the owner.

- The counterparty account represents a record of receivables and liabilities in relation to a counterparty which in this case is Fund A.

- The rounding account represents an account owned by the house and where any rounding differences gets booked.

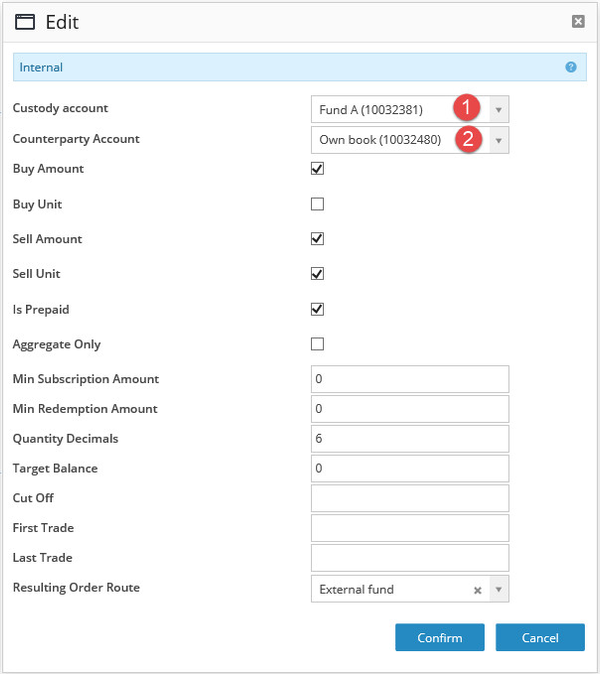

The configuration for the execution interface of the type "Internal" looks like this:

- The Custody Account is where the fund units will be stored and has the same reasoning as for the External Interface.

- The Counterparty Account is the own book account with the house since that is the counterparty to all internal trades.

The quick movie below describes the flow of events that will take place when we continue with this actual trade.

Internal order entry

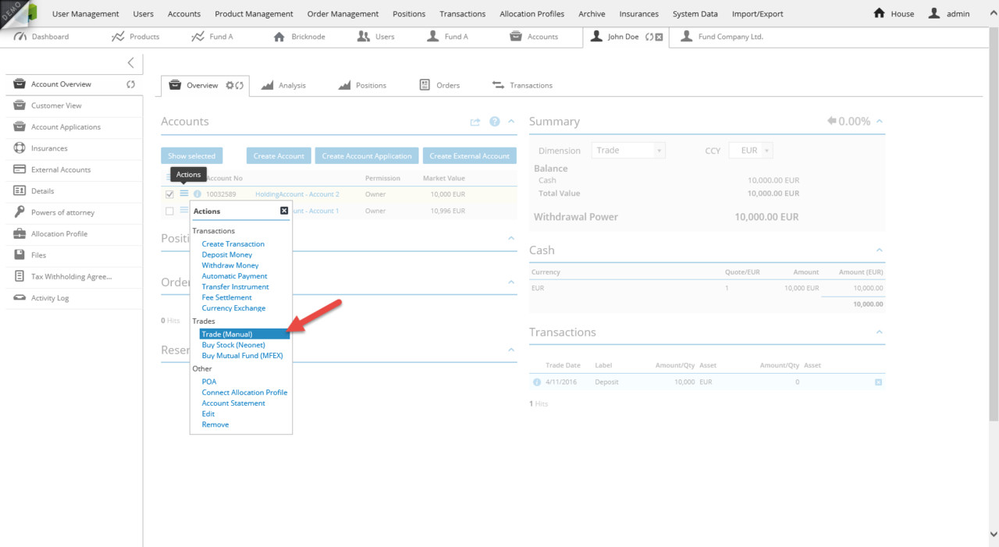

Order entry can take place from the customer itself via the customer front end, by an advisor in the advisory interface or by a back office representative. For this article we will use the back office representative.

Navigate to a customer account and open the action menu in order to select a trade option.

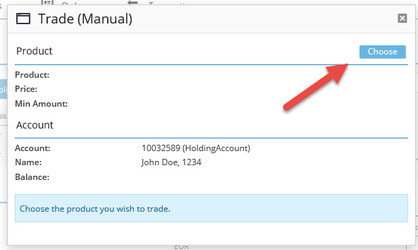

Choose a product to trade.

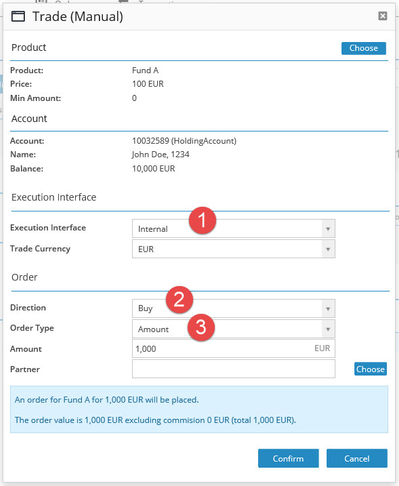

- For Execution Interface we will select Internal since the order is going to be placed with the house book account as the counterparty.

- The direction of this order is a buy order.

- The order type is Amount since we will be sending a fixed amount of money that we want to use for making the purchase. The other option is to use quantity of units.

View the movie below to understand the order process.

External order entry

The next step is to generate external orders where trades are made with the actual investment fund on behalf of the customers. The external orders can be generated manually or by using the automated Netting of internal orders.

Since the Internal orders are being traded with the house book account as the counterparty we can now navigate to the house account and enter orders for the same fund using the Execution Interface External Fund as the trading route as the video below demonstrates.

© 2009 - 2023 Huddlestock Technologies AB All rights reserved | Huddlestock Terms of use | Support portal