When do we use INTC

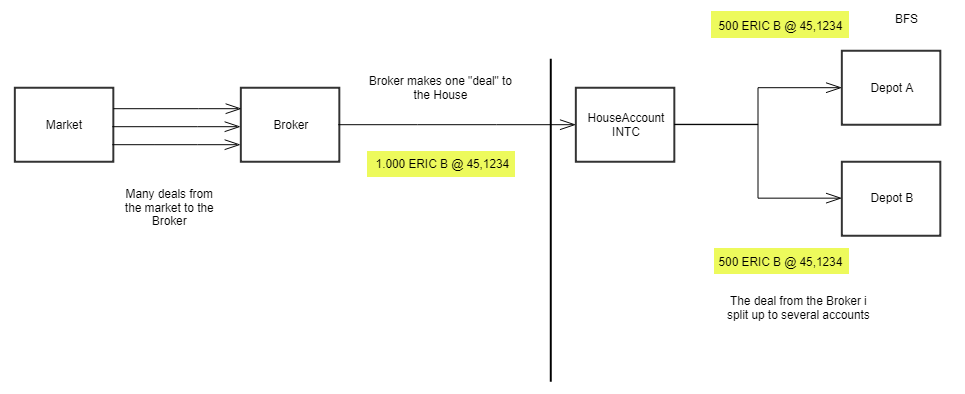

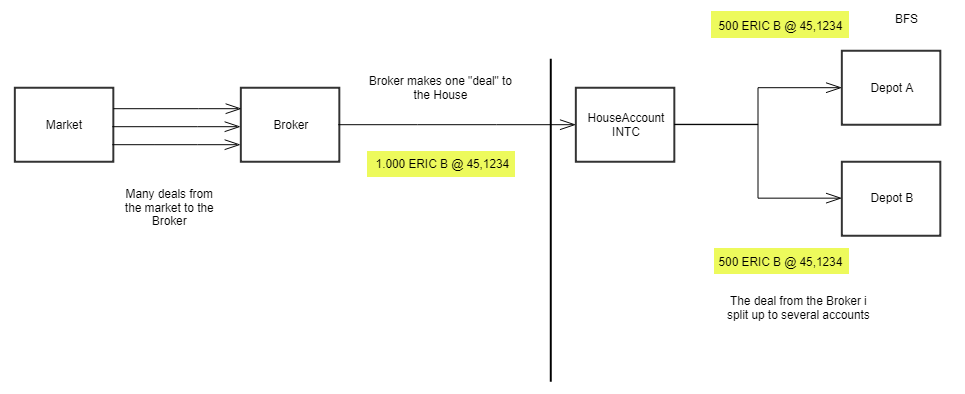

INTC is used when transactions are booked over an house account and the price IS NOT altered ("technical sell/buy"). This feature can be used when the house is buying on the market and selling to customer/customers. It can also be used when two customer make a deal. Thus, the INTC should only be used when trading capacity is AOTC and is not to be used when trading capacity is DEAL.

When reporting, Trading Capacity is always AOTC, never DEAL or MATCH. The trading Venue can be a market or OTC (XOFF).

| No | Field | Values Report #1 | Values Report #2 | Values Report #3 |

|---|

| 4 | Executing entity identification code | {LEI} of Investment Firm X | {LEI} of Investment Firm X | {LEI} of Investment Firm X |

| 7 | Buyer identification code | {LEI} of CCP for Trading Venue M | INTC | INTC |

| 16 | Seller identification code | INTC | {LEI} fo Client A | {LEI} of Client B |

| 28 | Trading date time | 2018-09-16 09:20:15.374 | 2018-09-16 09:20:15.374 | 2018-09-16 09:20:15.374 |

| 29 | Trading capacity | AOTC | AOTC | AOTC |

| 30 | Quantity | 1000 | 500 | 500 |

| 33 | Price | 45,1234 | 45,1234 | 45,1234 |

| 36 | Venue | Segement {MIC} of Trading Venue M | XOFF | XOFF |

| 62 | Short selling indicator |

| SESH | SELL |

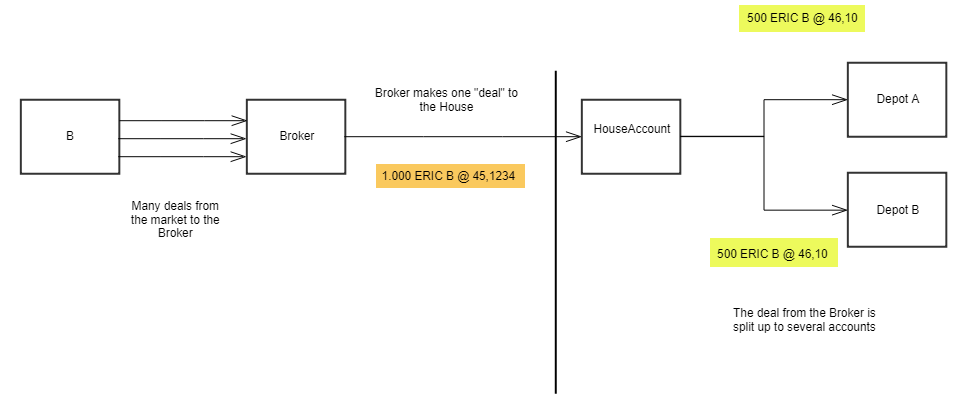

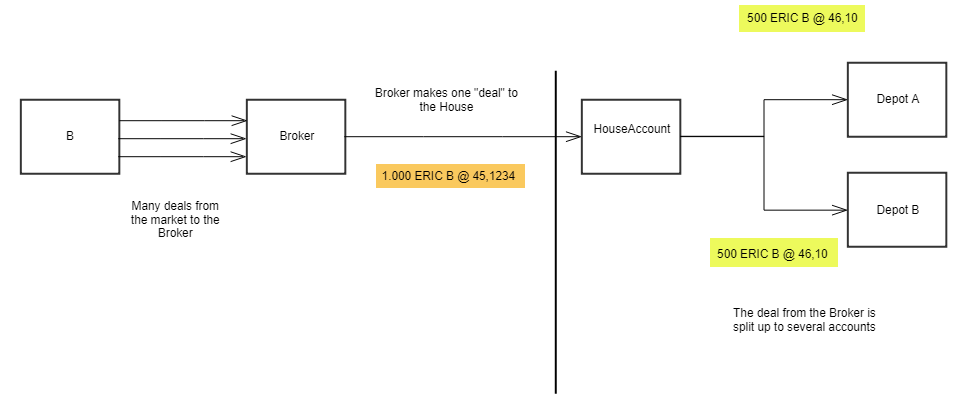

When do we NOT use INTC

- When the house takes a spread in the deal then we need to book it over the house account and not use INTC

- When there is only one depot involved in the deal you can book it over the house and then use trading capacity = DEAL

The aggregate client account (‘INTC’) should only be used in the circumstances set out in these Guidelines. It should not be used for reporting an order for one client executed in a single execution or for an order for one client executed in multiple executions. Where there is a transfer into the aggregate client account (‘INTC’) there should be a corresponding transfer out of the aggregate client account within the same business day of the executing entity in the transaction report such that the aggregate client account is flat. The apparent movement through ‘INTC’ is a convention used for reporting to provide a link between the market side and client side of transactions and does not indicate that such a client account exists in reality or that ownership of the instrument actually passes through the Investment Firm’s books.

| No | Field | Values Report #1 | Values Report #2 | Values Report #3 |

|---|

| 4 | Executing entity identification code | {LEI} of Investment Firm X | {LEI} of Investment Firm X | {LEI} of Investment Firm X |

| 7 | Buyer identification code | {LEI} of CCP for Trading Venue M | {LEI} of Investment Firm X | {LEI} of Investment Firm X |

| 16 | Seller identification code | {LEI} of Investments Firm X | {LEI} fo Client A | {LEI} fo Client B |

| 28 | Trading date time | 2018-09-16 09:20:15.374 | 2018-09-16 09:35:10.146 | 2018-09-16 09:35:10.146 |

| 29 | Trading capacity | DEAL | DEAL | DEAL |

| 30 | Quantity | 1000 | 500 | 500 |

| 33 | Price | 45,1234 | 46,10 | 46,10 |

| 36 | Venue | Segement {MIC} of Trading Venue M | XOFF | XOFF |

| 62 | Short selling indicator | SESH | SESH | UNDI |