BFS Version: 2.X

A Fund Instrument is the tradable instrument issued by a Fund Entity.

Entity is a Legal Entity that represents a fund like an investment fund. A Fund Entity is then tied to a Fund company that manages the fund.

The legal structure looks like the chart below.

To create a fund instrument navigate to "Product Management" and "Mutual Funds" and click the "Create" button .

Enter the properties as follows: Type: "Mutual Funds", Default Marketplace: leave empty since it is not applicable. Status controls the listing of intruments, Visible status controls the visibility of trade buttons, i.e. whether an instrument is tradable. When an instrument is in "Phone" status the buttons for trading will open a dialog box with information on how to perform a phone order. Name: the name of the fund instrument composed by the name of the fund entity and the fund class if applicable, ISIN: 12 digits, Fund Entity: the issuer of the instrument, Fund Company: is auto-filled, Dividend Type: "Reinvest" or "Dividend", Currency: the currency in which the fund is traded, Tax Country: the tax domicile of the fund, Decimals and Quanitity Decimals both denote the number of decimals used for amounts in orders, transactions and positions. Multiplier should always be 1 for fund instruments. Price is last known price (NAV) for the instrument and Price Date is the date of last known price.

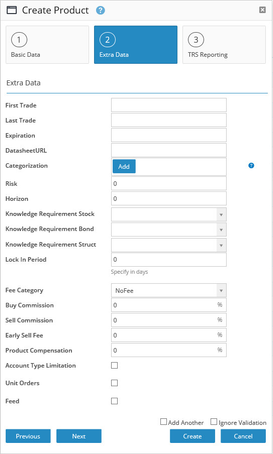

On the second tab you will find more properties as follows. First Trade and Last Trade set time limits for when the instrument is tradable. If they are left empty, no such limits will be set and the instrument will be tradable. Expiration controls when the instrument will expire. At the moment these dates exist for information only and do not affect the business logic. Datasheet URL provides a link for a document (pdf) with more information about the instrument.

For Categorization see separate article Instrument Categorization.

Risk, Horizon, the various Knowledge Requirements and Lock In Period are not applicable for Fund Instruments and can be left as default. Select appropriate Fee Category. See separate article for more on /wiki/spaces/KB/pages/66584622. Leave Buy Commission, Sell Commission, Early Sell Fee and Product Compensation as default since do not apply for fund instruments.

If the instrument is to be allowed for trading for certain account types only, then the Account Type Limitation box should be checked and the limitations can be set up at a later stage. The Unit Orders and Feed checkboxes can be left unchecked since do not apply for fund instruments.

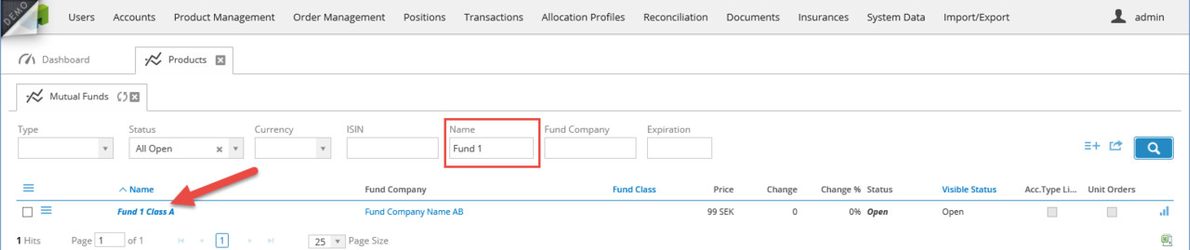

To continue making the settings for the instruments open it by finding it in the product list and click on its name.

Execution Interfaces

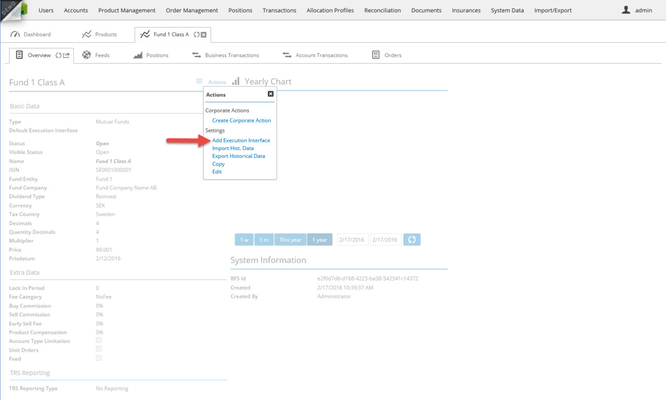

To enable trading of an instrument, settings must be applied for the instrument for each order type. The set of settings for each order type is called an "Execution Interface". To add an execution interface, open the action menu and click on "Add Execution Interface".

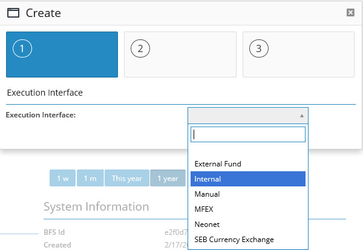

Then you will have to select the type of execution interface you want to add and will be presented with a set of properties determined by you selection.

You will find information about the settings for each execution interface type in the documentation of the various order types: Internal Orders, External Fund Orders.