Versions Compared

Key

- This line was added.

- This line was removed.

- Formatting was changed.

| Page Tree | ||

|---|---|---|

|

Bonds

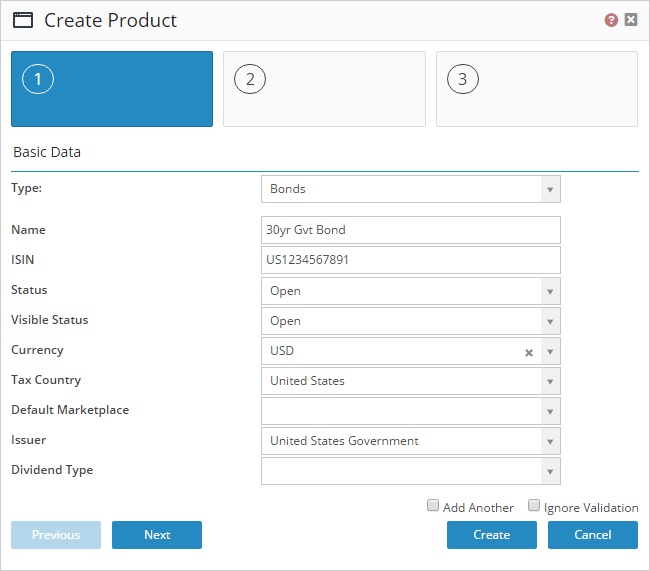

The default way to configure Bonds in BFS is to have them traded in nominal values and quoted in percentage values. For example, if a Bond has a minimum lot size of 100,000 USD and the price is 98% the purchase price for 100,000 nominal amount will be 98,000. To configure this instrument do the following.

| Property | Description |

|---|---|

| Type | The instrument type, select Bonds |

| Name | The name of the instrument |

| ISIN | The ISIN-code of the instrument |

| Status | The status determines what user type the instrument should be available to |

| Visible Status | The status determines what user type the instrument should be visible to |

| Currency | The currency that the instrument is based in |

| Tax Country | The country where the instrument is based according to tax reasons |

| Default Marketplace | The default marketplace where the instrument is traded |

| Issuer | The legal entity that has issued the instrument |

| Dividend Type | If dividends are issued or re-invested in the instrument, not widely used for bonds. |

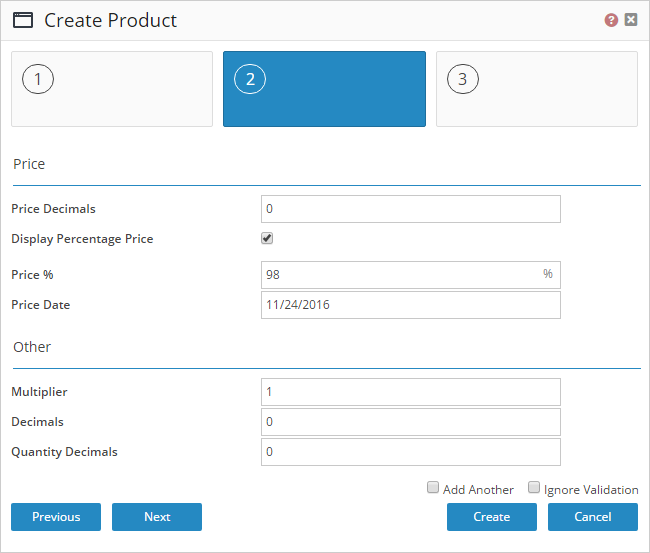

| Property | Description |

|---|---|

| Price Decimals | The number of decimals to use when showing the price of the instrument |

| Display Percentage Price | If checked the price will be displayed as a percentage value, in the database the value of 98% will be stored as 0.98 but shown as 98% |

| Price % | The price of the instrument |

| Price Date | The date when the price was set |

| Multiplier | The value multiplier of the instrument. Using the bond example above the instrument could be configured with a value multiplier of 100,000 and then the user could enter a lot of 1 as the quantity and that would mean that they are trading one bond contract with a face value of 100,000. Best practice is to set the value multiplier to 1 and have the user enter 100,000 as the quantity of units to trade. This is called trading in nominal amounts. The minimum lot size should then be defined on the trade route (Execution Interface) that we configure for the instrument. |

| Decimals | This is a legacy property that should be left blank |

| Quantity Decimals | This is the number of decimals that should be used for the units. The bond should have 0 decimals for the quantity since we cannot trade 0.5 bonds. Funds on the other hand could have 0.00001 for example since fund units are commonly traded in fractions of whole units. |

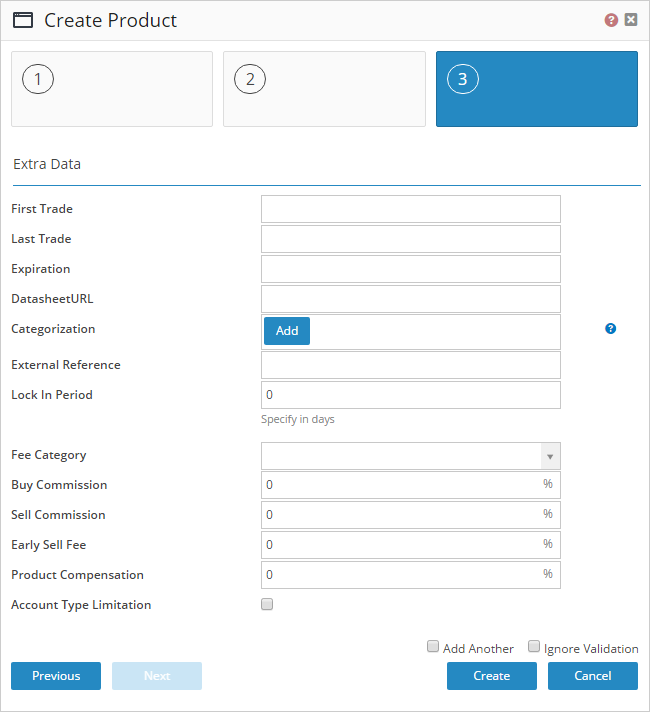

| Property | Description |

|---|---|

| First Trade | The first date on which the instrument should be available for trading |

| Last Trade | The last date on which the instrument should be available for trading |

| Expiration | The date on which the instrument will expire |

| Datasheet URL | A link to an instrument description |

| Categorization | Instrument Categorization |

| External Reference | A reference that could be used to link the instrument to an external system or some other reference |

| Lock In Period | The period that a legal entity should be locked in before being able to sell after having purchased the bond |

| Fee Category | Which fee category the instrument should belong to according to /wiki/spaces/KB/pages/66584622 |

| Buy Commission | The percentage commission charged on buy orders |

| Sell Commission | The percentage commission charged on sell orders |

| Early Sell Fee | The percentage fee charged on orders that are being executed within the lock in period. |

| Product Compensation | The percentage of kickback that should be given to the associated re-seller on the orders of the bond |

| Account Type Limitation | Determines if the instrument should be limited to certain account types. |