Versions Compared

Key

- This line was added.

- This line was removed.

- Formatting was changed.

With this app you can manage TRS2 reporting for regulators.

Documentation

| Child pages (Children Display) | ||||

|---|---|---|---|---|

|

TRS2 in Bricknode Broker

In this article will we will describe how TRS2 works in Bricknode Broker. We will describe TRS2 based on the manual flow, but it works the same way in the other workflows.

The instruments need to have some settings, default marketplace and MiFID Country, to be able to be TRS2 reported. You will find these settings under System Data > Places. When placing an order we will have to enter TRS information.

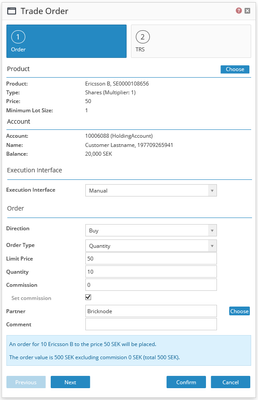

BUY

Trade order

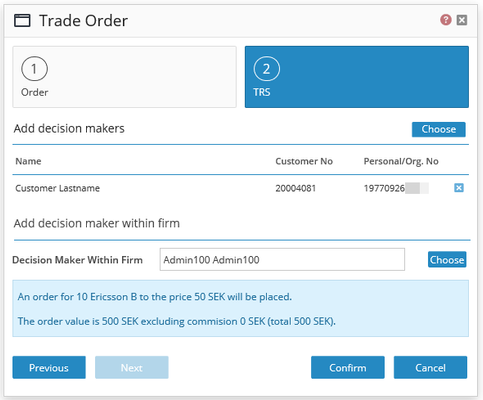

When placing a trade order in an instrument that should be TRS reported we will need to enter decision makers and decision makers within firm. This is used to identify the persons who makes the decision to acquire the financial instrument.

| 1 Order | 2 TRS |

|---|---|

|  |

| Property | Description |

|---|---|

| Decision makers | The user/customer is pre-filled. Possible to select several decision makers. |

| Decision makers within firm | Who is responsible for the decision to acquire the financial instrument on the investment firm. |

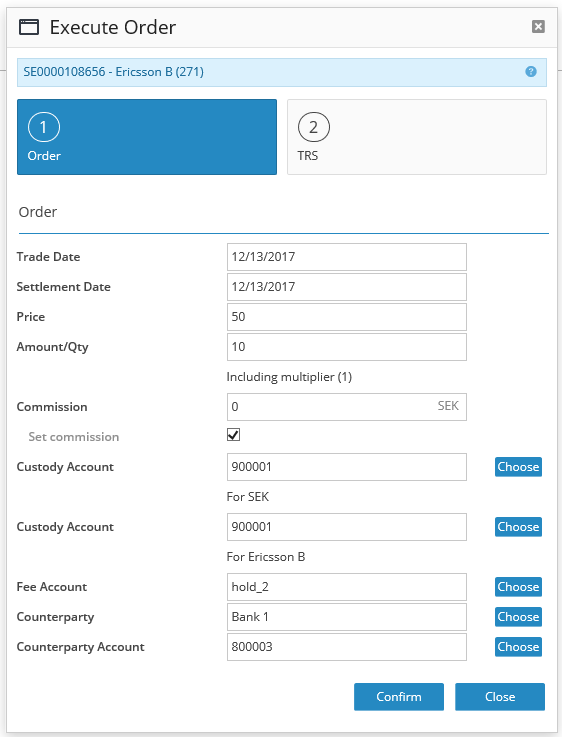

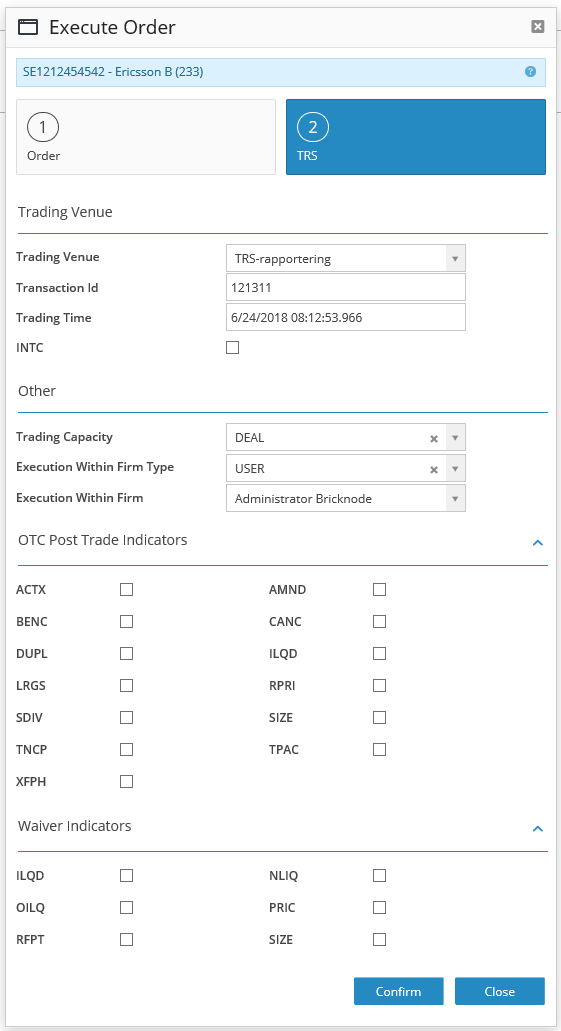

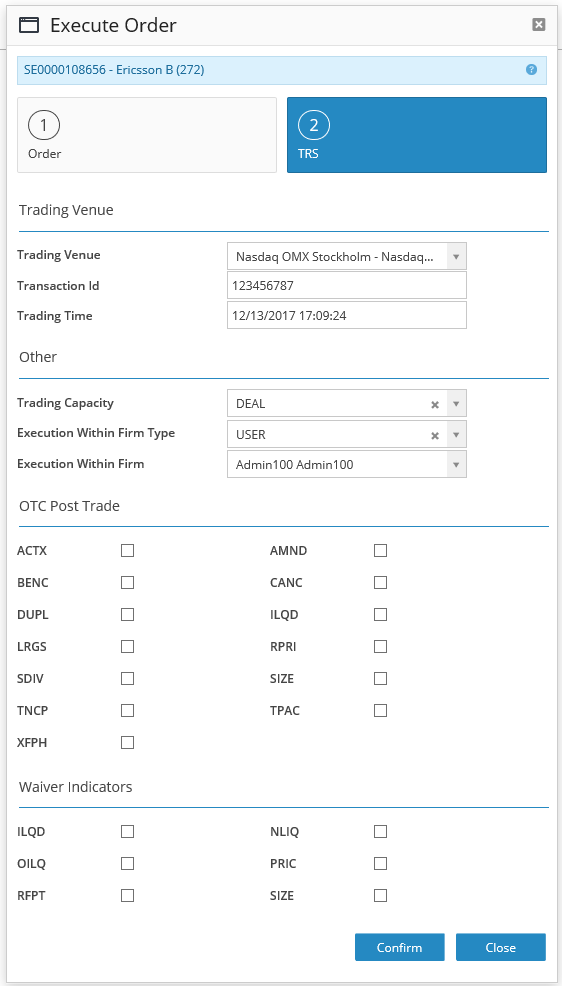

Execute order

When executing an order we have to add TRS information about the order.

| 1 Order | 2 TRS |

|---|---|

|

|

| Property | Description | Extended description |

|---|---|---|

| Trading Venue | Where the instrument is traded, is collected from Places in System Data. But can be changed if default for the instrument is not used. | |

| Transaction Id | This is a number generated by trading venues, should be entered if the trading venue are XCOP, XHEL, XOFF, XOSL or XSTO. | |

| Trading Time | Trading date and time Swedish: YYYY-MM-DD HH:MM:SS.MMM English: MM/DD/YYYY HH:MM:SS.MMM | Essential to enter time with seconds and milliseconds |

| INTC | INTC is a technical account that allows the house to trade securities and then distribute them to customers accounts and still report them as AOTC and not DEAL, which would have been the case if trading over a house account. INTC can, for example, be used when issuing structured products that were first booked into a house account and then booked at the customer account. | |

| Trading Capacity | DEAL: Dealing on own account | If the counterparty account at the instrument belongs to the house, DEAL will be default else AOTC. |

| Execution Within Firm Type | USER: Natural persons ALGO: Algorithms | Code used to identify the person or algorithm within the investment firm who is responsible for the execution. |

| Execution Within Firm | Who is responsible for the execution at the investment firm. | |

| OTC Post Trade | ACTX: Agency cross | Select one or more. Indicator as to the type of transaction in accordance with Articles 20(3)(a) and 21(5)(a) of Regulation (EU) No 600/2014. |

| Waiver Indicators | For equity instruments: For non-equity instruments: | Select one or more. Indication as to whether the transaction was executed under a pre-trade waiver in accordance with Articles 4 and 9 of Regulation (EU) No 600/2014. |

SELL

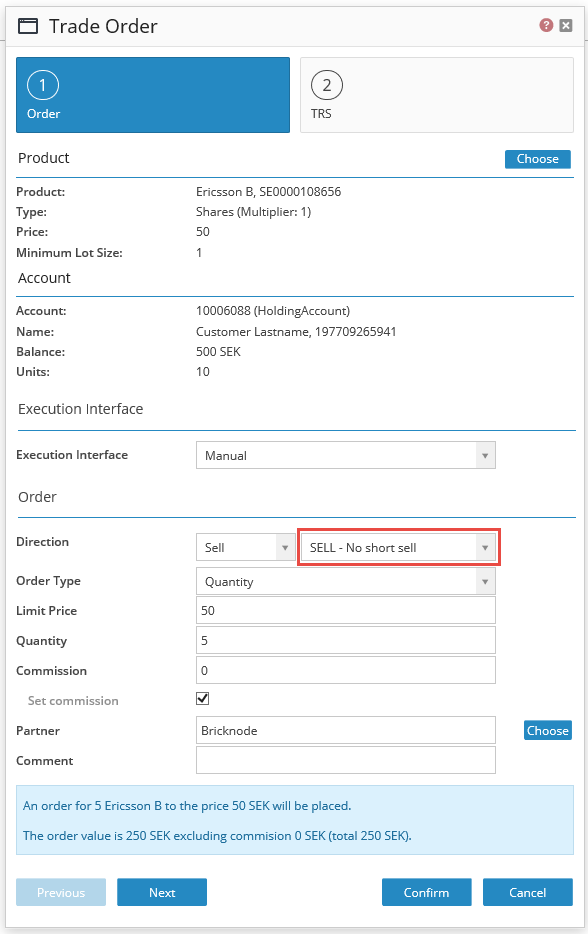

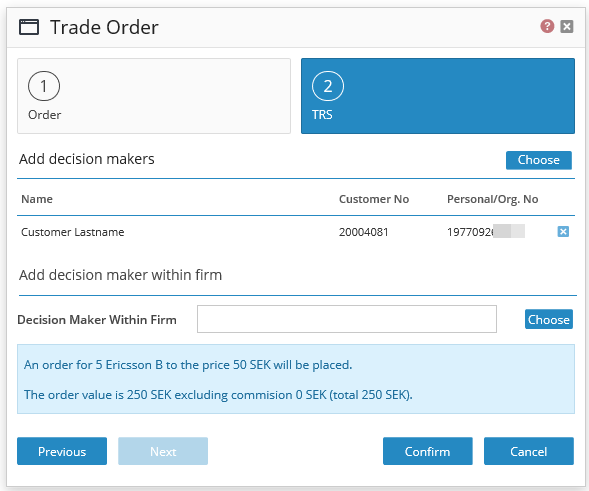

Trade order

When placing a trade order in an instrument that should be TRS reported we will need to enter decision makers and decision maker within firm. This is used to identify the persons who makes the decision to sell the financial instrument.

When selling an instrument we also have to enter sell reason, meaning, what is the reason for selling. There are four different types to choose from "UNDI", "SELL", "SSEX" or "SESH".

| 1 Order | 2 TRS |

|---|---|

|  |

| Property | Description | Extended description |

|---|---|---|

| Direction | ‘SELL’ - No short sale (default) | A short sale concluded by an investment firm on its own behalf or on behalf of a client, as described in Article 11. When an investment firm executes a transaction on behalf of a client who is selling and the investment firm, acting on a best effort basis, cannot determine whether it is a short sale transaction, this field shall be populated with ‘UNDI’ Where the transaction is for a transmitted order that has met the conditions for transmission set out in Article 4 of this Regulation, this field shall be populated by the receiving firm in the receiving firm’s reports using the information received from the transmitting firm. This field is only applicable when, the instrument is covered by Regulation (EU) No 236/2012, and the seller is the investment firm or a client of the investment firm |

| Decision makers | The user/customer is prefilled. Possible to select several decision makers. | |

| Decision makers within firm | Who is responsible for the decision to sell the financial instrument on the investment firm |

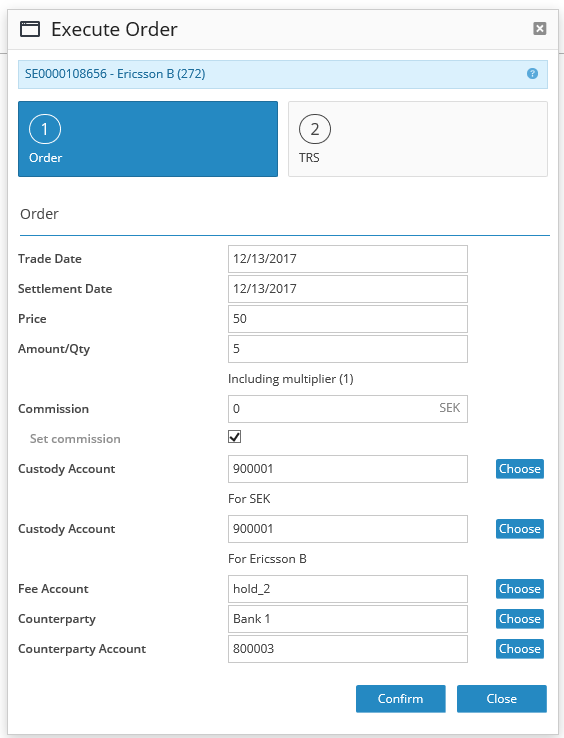

Execute order

When executing an order we have to add TRS information about the order.

| 1 Order | 2 TRS |

|---|---|

|

|

| Property | Description | Extended description |

|---|---|---|

| Trading Venue | Where the instrument is traded, is collected from Places in System Data. | |

| Transaction Id | This is a number generated by trading venues, should be entered if the trading venue are XCOP, XHEL, XOFF, XOSL or XSTO. | |

| Trading Time | Trading date and time Swedish: YYYY-MM-DD HH:MM:SS.MMM English: MM/DD/YYYY HH:MM:SS.MMM | Essential to enter time with seconds and milliseconds |

| Trading Capacity | DEAL: Dealing on own account | If the counterparty account at the instrument belongs to the house, DEAL will be default else AOTC. |

| Execution Within Firm Type | USER: Natural persons ALGO: Algorithms | Code used to identify the person or algorithm within the investment firm who is responsible for the execution. |

| Execution Within Firm | Who is responsible for the execution at the investment firm. | |

| OTC Post Trade | ACTX: Agency cross | Select one or more. Indicator as to the type of transaction in accordance with Articles 20(3)(a) and 21(5)(a) of Regulation (EU) No 600/2014. |

| Waiver Indicators | For equity instruments: For non-equity instruments: | Select one or more. Indication as to whether the transaction was executed under a pre-trade waiver in accordance with Articles 4 and 9 of Regulation (EU) No 600/2014. |

DEAL

When the order is executed, a deal will be created. The TRS2 app will retrieve all information from the deal.

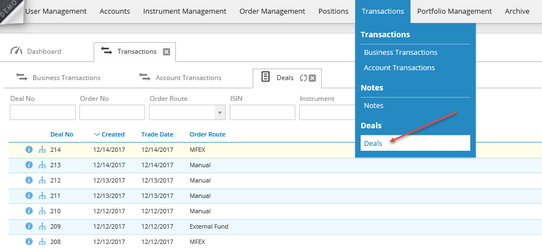

Navigate to Transactions > Deals to view the lists with Deals.

Click at "i" to view the TRS info.

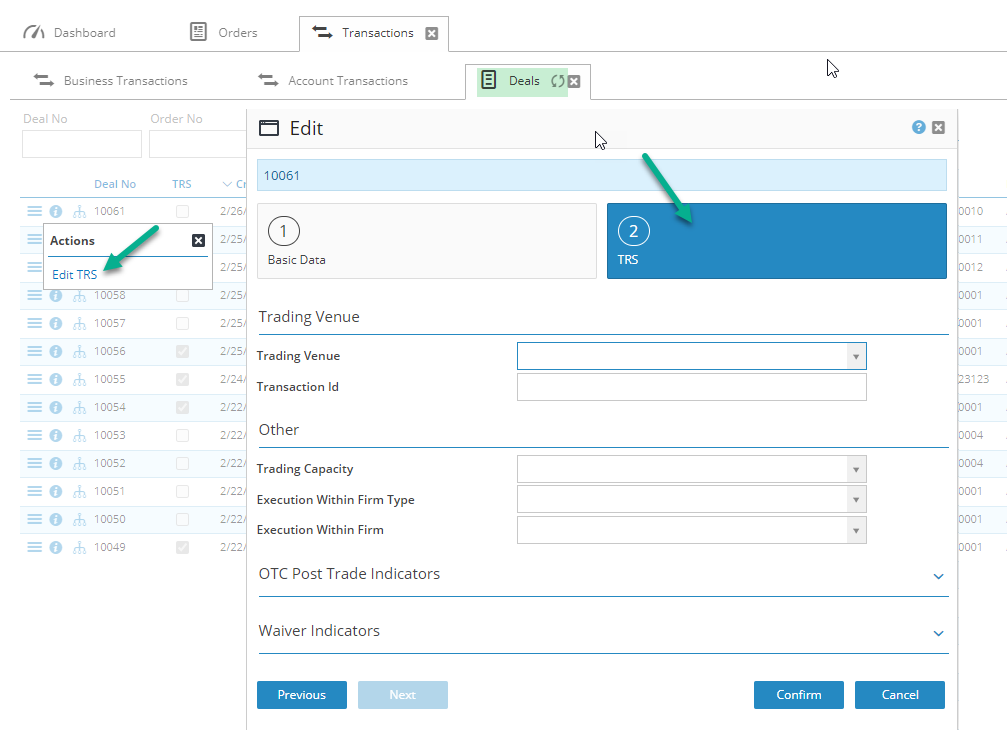

You can from version 2.28 edit the TRS information on the deal. Click Edit TRS in the action menu.

Image Added

Image Added

...