...

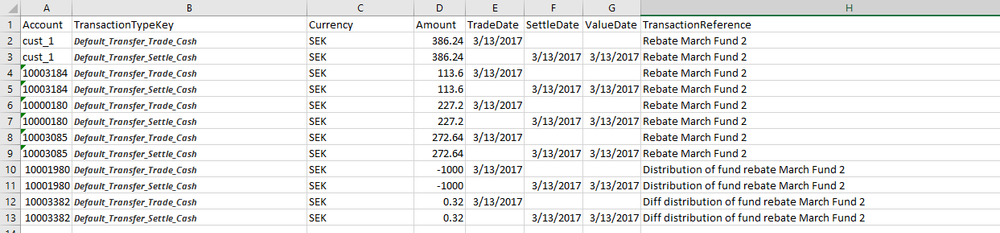

We must also remember to create two transactions for each account, one for the trade dimension and one for the settle dimension and we also need to include any transactions for our custody accounts or house BFS accounts where we have parked the fee rebate until now. Lets assume that we are not going to conduct a transfer of funds between custody accounts but we have parked the 1,000 SEK rebate when we received it in a house BFS account with number 10001980 so we need to transfer these funds out of that account.

After rounding the rebate per unit we will also get a difference of 0.32 SEK that we can place in our own house fee account with number 10003382. If we want to differentiate these transactions in a more distinct way than only Transaction Reference Texts we can create a new Transaction Type or use certain Transaction Types that already exists. If we want to be able to separate these transactions in the tax reporting it is a good idea to create new transaction types, for example with the name Payment_FundRebate_Trade_Cash and Payment_FundRebate_Settle_Cash. However, for this example we will use the standard Default_Transfer_Trade_Cash and Default_Transfer_Settle_Cash. Another thing to remember when deciding what transaction types to use is that the return calculation setting of a transaction type like this has to be set to payment if the amount should be included in the result, in this case positive, of the account as opposed to a transfer which does not affect the return of an account.

The resulting transactions will look like the following image.

The resulting excel file is included below.

| View file | ||||

|---|---|---|---|---|

|