Versions Compared

Key

- This line was added.

- This line was removed.

- Formatting was changed.

| Page Tree | ||

|---|---|---|

|

Drawn taxes

isare included in KU21 and KU31

Drawn taxes are now included in the tax reports KU21 and KU31. The column ReportedDeductedTax (drawn taxes) has existed in the report but has not shown the drawn tax.

If the tax transaction can be linked to the dividend or report coupon interest, it will be included in column H (reported deducted tax).

There

are

scenarios

where

the

tax

app

can´t

link

the

tax

transaction

to

the

dividend.

You

will

then

recievereceive information

about

this,

partly

via an error message and parly via the excelfile whrere the tax transactions will have 0.via a warning message where you will receive information about the account and transaction number and partly via the excel file where the tax transactions will be 0. Image Added

Image Added

Image Added

Image Added

There are two exceptions.

- If the dividend and the tax transaction is made manually the tax app will not be able to connect the dividend to the tax transaction. There is nothing that connects the transactions.

- If the deducted tax is in another currency then the house, it will not be included in the KU Report.

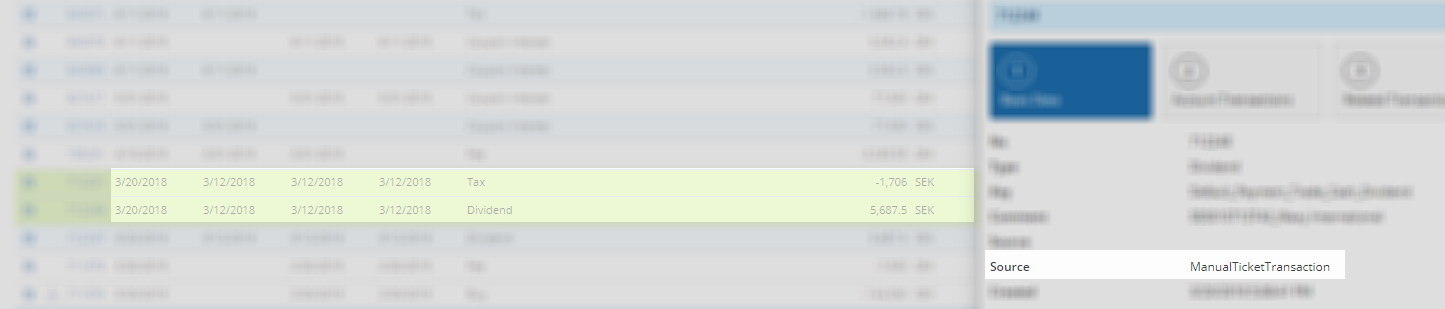

Finding the transaction in Bricknode Broker

Image Added

Image Added

Search for the account number in Bricknode Broker, navigate to the transaction list and find the transaction., navigate to the transaction list and find the transaction.

Click ![]() . In this example, the source is "ManualTicketTransaction" which means it is not made in batch with the corporate action add-on. Find the tax transaction and fill in the amount in deducted tax.

. In this example, the source is "ManualTicketTransaction" which means it is not made in batch with the corporate action add-on. Find the tax transaction and fill in the amount in deducted tax.

Image Added

Image Added